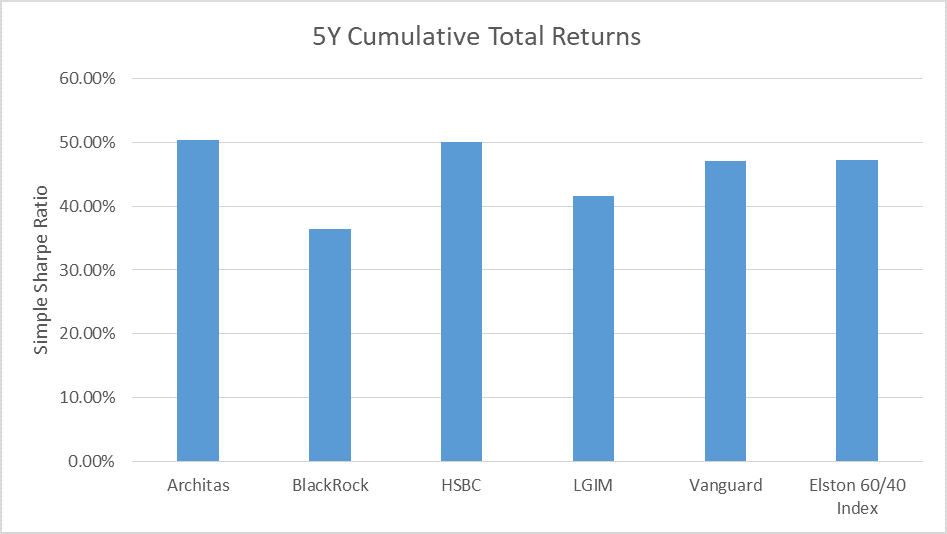

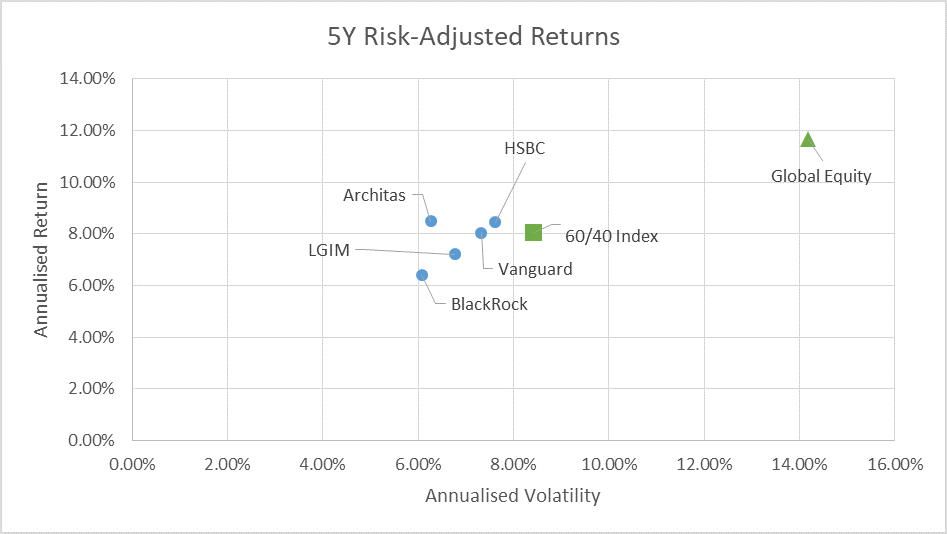

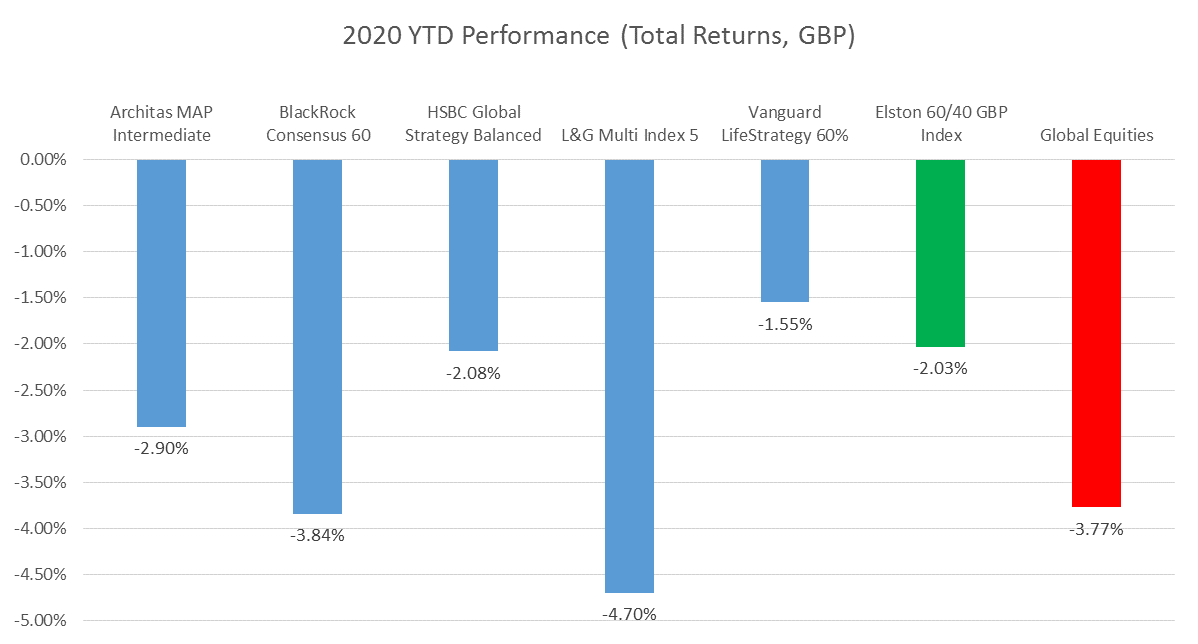

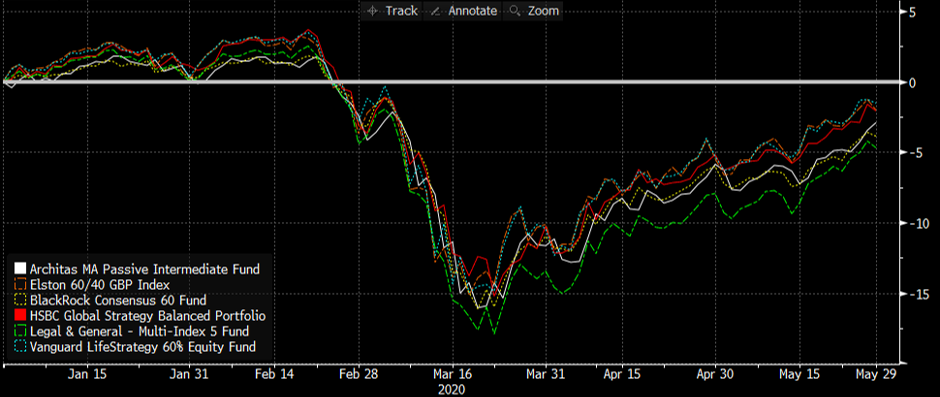

We analysed 5 year performance of major multi-asset index funds relative to the Elston 60/40 GBP Index to end December 2019, and a YTD update through the COVID-19 impact. We focused on the following multi-asset index funds* for performance analysis: Architas Multi-Asset Passive Intermediate fund, BlackRock Consensus 60 fund, HSBC Global Strategy Balanced fund, LGIM Multi-Index 5 fund and Vanguard LifeStrategy 60% Equity fund. Cumulative Returns Architas and HSBC have the best performing funds in absolute terms within this group: Source: Elston research, Bloomberg data Notes: Total returns in GBP terms, daily data, as at 31/12/19 Risk-adjusted returns Within this group, Architas has delivered best risk-adjusted returns within: Source: Elston research, Bloomberg data Notes: Annualised total returns in GBP terms, daily data. 5 year annualised daily volatility data as at 31/12/19 Performance in COVID-19’s “live fire stress-test” Looking at performance year to date, we see Architas, HSBC and Vanguard delivering performance most consistent with the 60/40 index. BlackRock Conensus 60 and L&G Multi-Index have delivered least consistent performance relative to this index, underperforming the 60/40 index by -1.81ppt and -2.67ppt respectively. Obviously those funds’ objectives are specific to each fund and are aiming neither to track nor beat the 60/40 index. But now we can track the performance of a “no-brainer”** 60/40 portfolio in real-time, it’s easier to see the value that multi-asset index funds add or substract relative to that plain vanilla benchmark. Multi-asset managers can add value through optimisation, tactical allocation and implementation efficiencies, for example. Source: Elston research, Bloomberg. As at 29/5/20 total returns basis, GBP terms.

Costs Ranked by Total Costs and Charges (“TCC”) which represents OCF plus transaction costs, HSBC offers the lowest cost option. OCF TCC HSBC 0.18% 0.22% BlackRock 0.22% 0.29% Vanguard 0.22% 0.26% LGIM 0.31% 0.31%*** Architas 0.47% 0.48% Source: manager data, as at end December 2019. ***estimated figure Value For Money Architas may look expensive on a TCC basis. But it has delivered best risk-adjusted performance in the period under review owing to their more dynamic asset allocation approach, so arguably offers good value for money on a risk-adjusted basis. For static allocation funds, the main differentiator is cost alone, on which basis HSBC offers best value for money, in our view. A less inappropriate benchmark Whilst our 60/40 benchmark by default may not be the "perfect" benchmark for these and other (balanced/medium-risk) multi-asset funds, it is certainly a less inappropriate benchmark than comparing a multi-asset fund to a FTSE 100 or Global Equity benchmark. Whilst individual fund houses may use composites for comparison, these may not be publicly available for analysis. The existince of a published standardised 60/40 benchmark enables cross-comparison, analysis and insights. *Fund tickers: ARINTDA, BRC60DA, HSWIPCA, LGMI5IA, VGLS60A respectively. Index ticker: 6040GBP Index **Abraham Okusanya's coinage in https://finalytiq.co.uk/cobras-unintended-consequences-multi-asset-funds/

Kevin Lynch

12/6/2020 14:18:47

A good article. Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed