Diversification: the only free lunch for investors Portfolio theory holds, and experience affirms, that true diversification means that the overall risk of a portfolio can be less than the risk of its constituent parts. The diversification effect is determined by correlation. Broadly speaking, the lower the correlation between asset classes, the greater the diversification effect when combined in a portfolio. This in the underlying principle behind combining equities and bonds to create a multi-asset approach. Whilst this traditional “asset-based” approach holds for the long-term. It fails to consider that correlations are not static but are dynamic. This means that diversification effect is also dynamic and changes with market conditions. The limits of asset-based diversification In stressed market conditions, the relationship (correlation) between asset classes tends to increase. This means that the diversification effect created by mixing asset classes is reduced. In order to introduce true diversification effect into a portfolio investors can use a risk-based approach to constructing portfolios. Asset-based or risk-based approach? The bulk of multi-asset portfolios in the UK market use what’s called a traditional “asset based” approach. This means that the target asset allocation drives the level of portfolio risk. The asset allocation for each portfolio is broadly fixed, and volatility therefore fluctuates. An alternative approach is called a “risk-based” approach. This means that a target risk characteristic for a portfolio – for example a minimum variance portfolio, or a risk parity approach – drives the asset allocation. Risk-based approaches explained We analyse three risk-based multi-asset strategies for GBP investors:

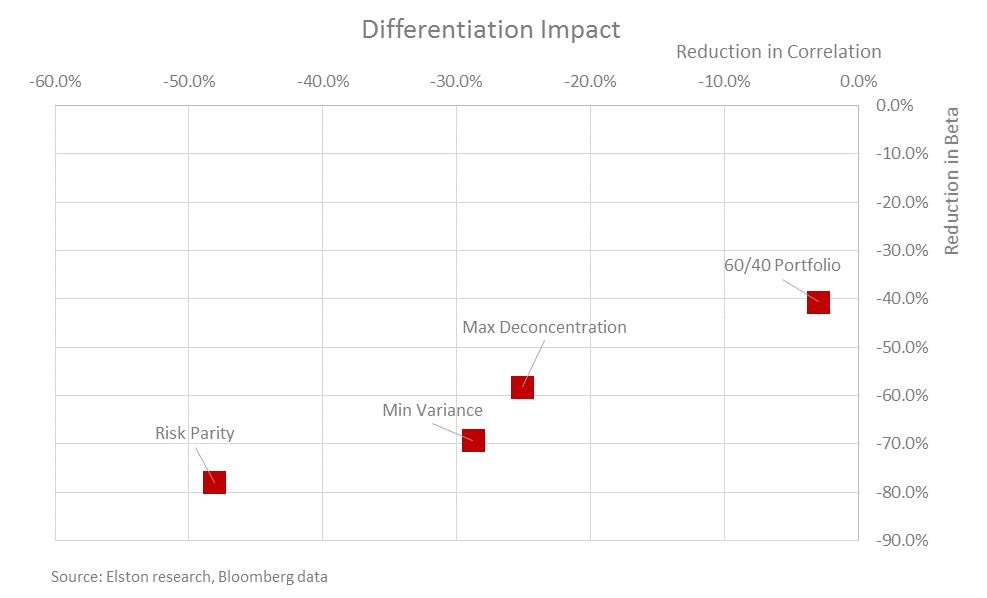

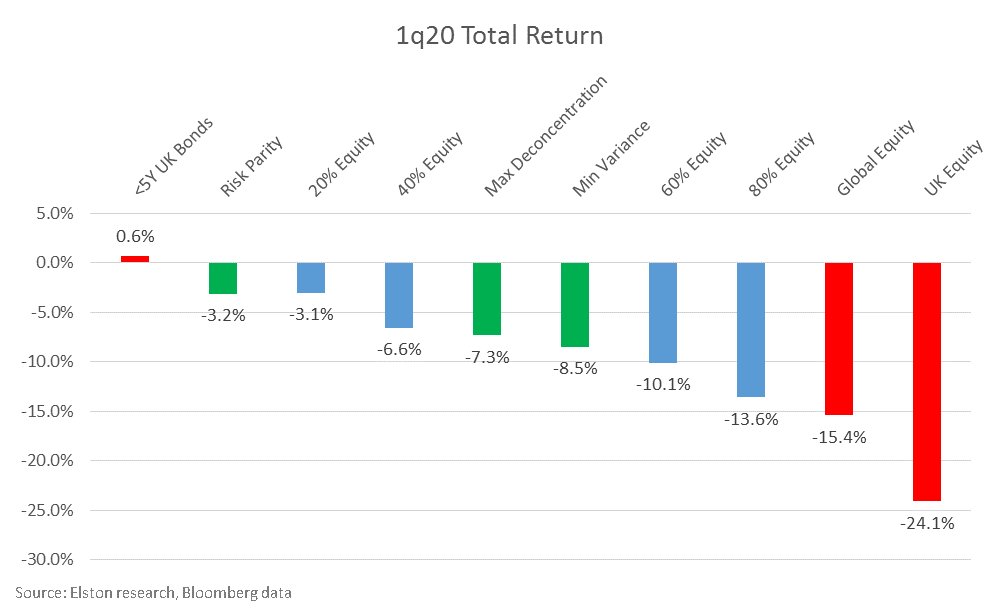

Differentiation impact Relative to global equities, whilst a 60/40 approach, represented by the Elston 60/40 GBP Index [6040GBP Index], reduces beta by 40.6%, it only reduces correlation by 3.0%. Put differently, there is very low diversification effect. By contrast, a risk parity approach, represented by the Elston Dynamic Risk Parity Index [ESBDRP Index], offer the greatest diversification effect as it reduces beta by 78.0% and correlation by 48.1%. 5 year data to 31st March 2020, GBP terms YTD performance Year to date, risk parity has provided greatest capital preservation relative to asset-based and other risk-based strategies. What next?

For investors looking at introduce true diversification into a multi-asset portfolio, incorporating an allocation to a dynamic multi-asset risk-based strategy, such as Max Deconcentration, Min Variance or Risk Parity makes sense. These systematic strategies can be delivered using portfolios of ETFs for liquidity, transparency and efficiency. For full report, see http://www.elstonetf.com/store/p12/Multi-asset_strategies%3A_1q20_update.htm Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed