|

High risk, complex Exchange Traded Products that amplify (with “leverage”) index’ moves in the same (“long”) or opposite (“short”) direction are designed for sophisticated investors who want to trade and speculate over the short-term, rather than make a strategic or tactical investment decisions. Whilst they can have a short-term role to play, they should be handled with care. If you think you understand them, then you’ve only just begun. In this series of articles, I look at some of the key topics explored in my book “How to Invest With Exchange Traded Funds” that also underpin the portfolio design work Elston does for discretionary managers and financial advisers. For more speculators and or more sophisticated risk managers there are a range of inverse (short) and leveraged (geared) ETPs that can rapidly add or remove upside or downside risk exposure in short-term (daily) market movements. The difference between speculating and investing should be clearly defined.

Owing to the higher degree of risk management and understanding required to use these products, they may not be suitable for DIY or long-term investors. However a degree of knowledge is helpful to identify them within a managed portfolio or amongst research sites. Defining terms Unlike their more straightforward unleveraged ETF cousins, leveraged and inverse or “short” ETNs should be for sophisticated investor or professional use only. So hold onto your seat. Shorting and leverage are important tools in a professional manager’s arsenal. But first we need to define terms. Going long: means buying a security now, to sell it at a later date at a higher value. The buyer has profited from the difference in the initial buying price and final selling price. Going short: means borrowing a security from a lender and selling it now, with an intent to buy it back at a later date at a lower value. Once bought, the security can be returned to the lender and the borrower (short-seller) has profited from the difference in initial selling and final buying price. Leverage: means increasing the magnitude of directional returns using borrowed funds. Leverage can be achieved by:

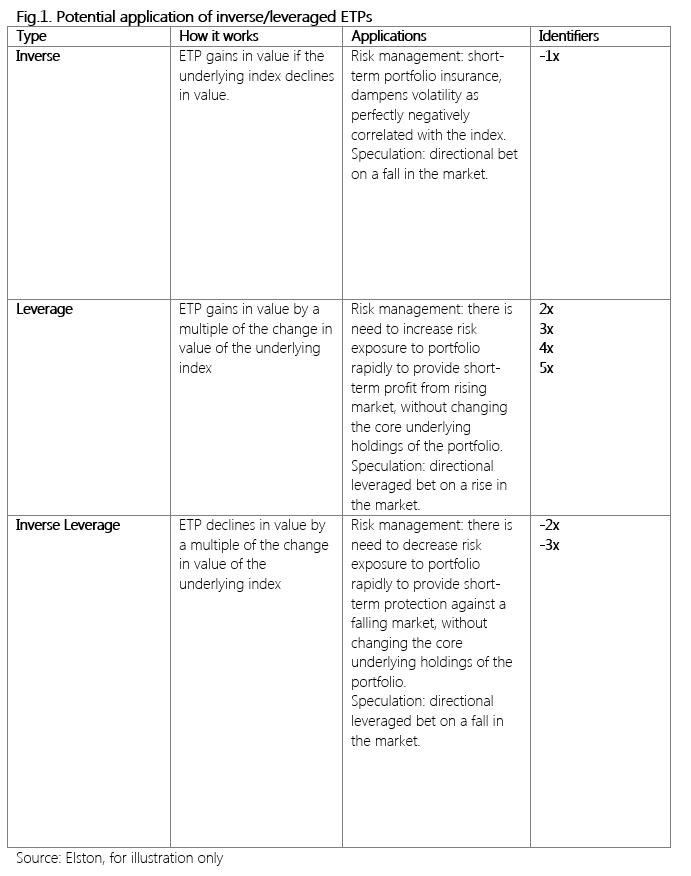

Underlying index: is the underlying index exposure against which a multiplier is applied. The underlying index could be on a particular market, commodity or currency. Potential applications Managers typically have a decision only whether to buy, sell or hold a security. By introducing products that provide short and/or leveraged exposure gives managers more tools at their disposal to manage risk or to speculate. Going short, and using leverage can be done for short-term risk management purposes, or for speculative purposes. Leverage in either direction (long-short) can be used either to amplify returns, profit from very short market declines, or change the risk profile of a portfolio without disposing of the underlying holdings. Short/Leveraged ETPs available to DIY investors The following types of short/leveraged ETPs are available to implement these strategies. Fig.1. Potential application of inverse/leveraged ETPs The ability to take short and/or leveraged positions was previously confined to professional managers and ultra-high net worth clients. The availability of more complex Exchange Traded Products gives investors and their advisers the opportunity to manage currency risk, create short positions (profit from a decline in prices) and create leveraged positions (profit more than the increase or decrease in prices).

Risks Leveraged and short ETPs have significantly greater risks than conventional ETFs. Some of the key risks are outlined below:

If concerned regarding risk of deploying short/leveraged ETPs, set a capped allocation i (eg no more than 3% to be held in leveraged/inverse ETPs, and a holding period for leveraged/inverse ETPs not to exceed 1-5 days). US Case Study: Inverse Volatility Blow Up VelocityShares Daily Inverse VIX Short-Term ETN (IVX) and ProShares Short VIX Short-Term Futures ETF were products created in the US for professional investors who wanted to profit from declining volatility on the US equity market by tracking the inverse (-1x) returns of the S&P VIX Short-Term Futures Index. The VIX is itself an reflecting the implied volatility of options on the S&P 500. As US equity market volatility steadily declined the stellar performance of the strategy in prior years not only made it popular with hedge funds[2], but also lured retail investors who are unlikely to have understood the complexity of the product. By complexity, we would argue that a note inversely tracking a future on the implied volatility of the stock market is hardly simple. On 5th February, the Dow Jones Industrial Average suffered its largest ever one day decline. This resulted in the VIX Index spiking +116% (from implied ~12% volatility to implied ~33% volatility). The inverse VIX ETNs lost approximately 80% of their value in one day which resulted in an accelerated closure of the product, and crystallising the one day loss for investors[3]. The SEC (US regulator) focus was not on the product itself but whether and why it had been mis-sold to retail investors who would not understand its complexity[4]. Summary In conclusion, on the one hand, Leveraged/Inverse ETP are convenient ways of rapidly altering risk-return exposures and provide tools with which speculators can play short-term trends in the market. Used by professionals, they also have a role in supporting active risk management. However, the risks are higher than for conventional ETFs and more complex to understand and quantify. RISK WARNING! Short and/or Leveraged ETPs are highly complex financial instruments that carry significant risks and can amplify overall portfolio risk. They are intended for financially sophisticated investors who understand these products, and their potential pay offs. They can be used to take a very short term view on an underlying index, for example, for day-trading purposes. They are not intended as a buy and hold investment. [1] https://seekingalpha.com/article/1457061-how-to-beat-leveraged-etf-decay [2] https://www.cnbc.com/2018/02/06/the-obscure-volatility-security-thats-become-the-focus-of-this-sell-off-is-halted-after-an-80-percent-plunge.html [3] https://www.bloomberg.com/news/articles/2018-02-06/credit-suisse-is-said-to-consider-redemption-of-volatility-note [4] https://www.bloomberg.com/news/articles/2018-02-23/vix-fund-blowups-spur-u-s-to-probe-if-misconduct-played-a-role Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed