|

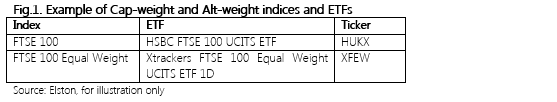

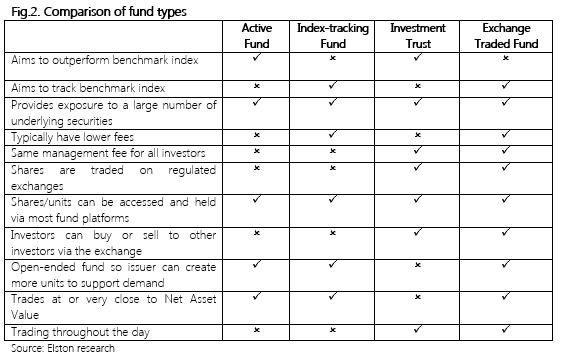

Compared to traditional retail funds, ETFs offer transparency, liquidity and efficiency [7 min read, Open as pdf] In this series of articles, I look at some of the key topics explored in my book “How to Invest With Exchange Traded Funds” that also underpin the portfolio design work Elston does for discretionary managers and financial advisers. Indexes: the DNA of an ETF An Exchange Traded Fund is an index-tracking investment fund that aims to track (perform exactly in line) with the benchmark index in the fund’s name. The index defines an ETF’s “DNA”. An index is a collective measure of value for a defined group of securities, where criteria for inclusion and weighting within that group are defined by a systematic set of rules. Indices can represent a basket of equities like the FTSE 100 Index (the “Footsie”) or a basket of bonds like the FTSE Actuaries UK Conventional Gilts All Stocks Index (the “gilts” index). Indices can be used as benchmarks to represent the performance of an asset class or exposure. ETFs aim to track these benchmark indices by holding the same securities in the same weights as the index. Whilst ETFs can be an equity fund or bond fund (amongst others) with respect to its underlying holdings and the index it tracks, the shares in those ETFs trade on an exchange like an equity. This means ETFs combine the diversification advantages of a collective investment scheme, with the accessibility advantages of a share, all at a management fee that is substantially lower than traditional active funds. These features make ETFs easy to buy, easy to switch and easy to own, revolutionising the investment process as well as reducing investment costs. Indices enable transparency ETFs are regulated collective investment schemes (often UCITS[1] schemes) that can be traded on a recognised exchange, such as the London Stock Exchange. Whereas the manager of a traditional active fund aims to outperform an index such as the FTSE 100 by overweighting or underweighting particular securities within that index or holding non-index securities, an ETF aims to deliver the same returns as the index by holding within the fund the same securities as the index in the same proportion as the index. If the index represents a basket of securities weighted by their respective size, it is a “Capitalisation-weighted index”: this is the traditional index approach. If the index represents a basket of securities weighted by a criteria other than their respective size, it is an “Alternatively-weighted” index. For example, an equal weighted index means all the securities in an index are given an equal weight. [1] UCITS: Undertakings for Collective Investment in Transferable Securities (the European regulatory framework for retail investment funds) ETFs track indices, and indices have rules. Index rules are publicly available and set out how an index selects and weights securities and how frequently that process is refreshed. Indices therefore represent a range of investment ideas and strategies, but codified using a rules-based approach. This makes ETFs’ investment approach transparent, systematic and predictable, even if the performance of securities within the index is not. Furthermore, ETFs publish their full holdings every day so investors can be sure of what they own. This makes ETFs’ investment risks transparent. The investment risk-return profile of an ETF is directly link to the risk-return profile of the index that it tracks. Hence ETFs tracking emerging market equity indices are more volatile than those tracking developed market indices, which in turn are more volatile than those tracking shorter-duration bond indices. As with direct shares, traditional active mutual funds and index-tracking funds, when investing in ETFs, capital is at risk, hence the value of investments will vary and the initial investment amount is not guaranteed. ETFs vs traditional funds An ETF is different to other types of investment fund in the following ways:

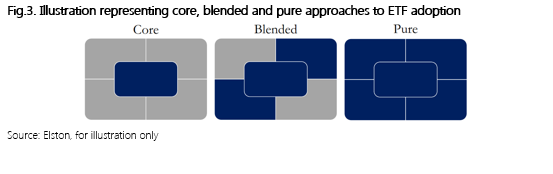

The primary advantage of ETFs is the additional liquidity that a “secondary market” creates in the shares of that ETF (meaning the ability for investors to buy or sell existing shares of that ETF amongst themselves via a recognised exchange). However it is important to note that ultimately the liquidity of any ETF is only as good as its underlying assets. Traditional mutual funds can be traded once a day and investors transact with the fund issuer who must buy or sell the same amount of underlying securities. Fund issuers have the right to “gate” funds and refuse to process redemptions to protect the interests of the broader unitholders of the fund. If this happens, there is no secondary market for shares/units in the fund. Recent examples of “gating” include UK property funds after the Brexit vote[1] and strategic bond funds as interest rates expectations rose[2]. By contrast, Exchange Traded Funds can be traded throughout the day and investors generally transact with each other via the exchange. If necessary the fund issuer must create (or redeem) more units to meet demand and then buy (or sell) the same amount of underlying securities. Whilst, the liquidity of the fund is ultimately only as good as the underlying assets, there is, however, additional liquidity in the secondary market for shares in the fund which can be bought or sold amongst investors. For example, there have been circumstances when some markets have closed, and the underlying shares aren’t traded, the ETF continues to trade (albeit a premium or discount to Net Asset Value (NAV) may appear owing to the inability of the ETF to create/redeem units when there is no access to the underlying shares) and indeed becomes a vehicle of price discovery for when the market eventually reopens[3]. As regards fees, whereas funds have different fee scales for different types of investor based on share classes available, the fees on ETFs are the same for all investors meaning that the smallest investors benefit from the economies of scale that the largest investors bring. Whilst the active/passive (we prefer the terms non-index/index) debate grabs the headlines, it is this targeted acces to specific asset classes, fee fairness and secondary market liquidity that makes ETFs so appealing to investors of any size. A summary of similarities and differences of ETFs to other types of fund is presented in the table below: [1] https://seekingalpha.com/article/3986464-investors-u-k-property-etfs-affected-9b-fund-lock [2] https://www.ft.com/content/a007d563-4454-3c92-aeaa-4d0dc64e425b [3] https://www.cnbc.com/id/41354109 From the table above, we see how, ETFs offer the combined functionality of a collective investment scheme with the flexibility and access of an exchange traded instrument. Ways to use ETFs We see three key applications for ETFs in portfolio construction: “core”, “blended” and “pure”. Using ETFs for a core portfolio means creating and managing a core asset allocation constructed using ETFs, with satellite “true active” fund holdings for each of the same exposures in an attempt to capture some manager alpha at a fund level. This enables a portfolio manager to reduce partially the overall client costs without forsaking their hope of higher expected returns from “true active” non-index fund holdings for each exposure. Using ETFs for a blended portfolio means creating and managing an asset allocation constructed using ETFs for efficient markets or markets where a portfolio managers may lack sufficient research or experience; and active funds for asset class exposures where the manager has high conviction in their ability to deliver alpha from active fund or security selection. For example, a UK portfolio manager with high conviction in UK stock picking may prefer to access US equity exposure using an ETF that tracks the S&P500 rather than attempting to pick stocks in the US. Use of ETFs for a pure ETF Portfolio means creating and managing an asset allocation constructed using ETFs entirely. For example, a portfolio manager looking to substantially reduce overall client costs without compromising on diversification is able to design a portfolio using ETFs for each asset class and risk exposure. Fig.3. Illustration representing core, blended and pure approaches to ETF adoptio Who uses ETFs and why?

ETFs are used by investors large and small to build and manage their portfolios. As well as providing low cost, diversified and transparent access to a market or asset class, the liquidity of ETFs namely that 1) they only invest in liquid securities that index-eligible and 2) the ETF can itself be bought or sold between market participants means that investors can adapt their portfolio in a timely basis, if required. Put differently traditional funds are one of the few things in the world that you can only sell back to the person you bought it from (the fund issuer), and that fund issuer has the right to say no. Furthermore, the dealing cycles for traditional funds are long. If you want to sell one to buy another, it could take 4-5 days to sell and 4-5 days to buy. An 8-10 day round trip is hardly timely. In the meantime you may be out of the market, which could dramatically impact performance, particularly in periods of extreme volatility. By contrast, ETFs are designed to be tradable on a secondary market via an exchange, and can be bought and sold between market participants on the same day without the fund manager’s involvement. This means that if investors want to alter their risk posture to respond to changing events, they can do so instantly and effectively if required. ETFs have therefore grown in popularity as a core part of institutional and retail investor’s toolkit for portfolio and risk management. Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed