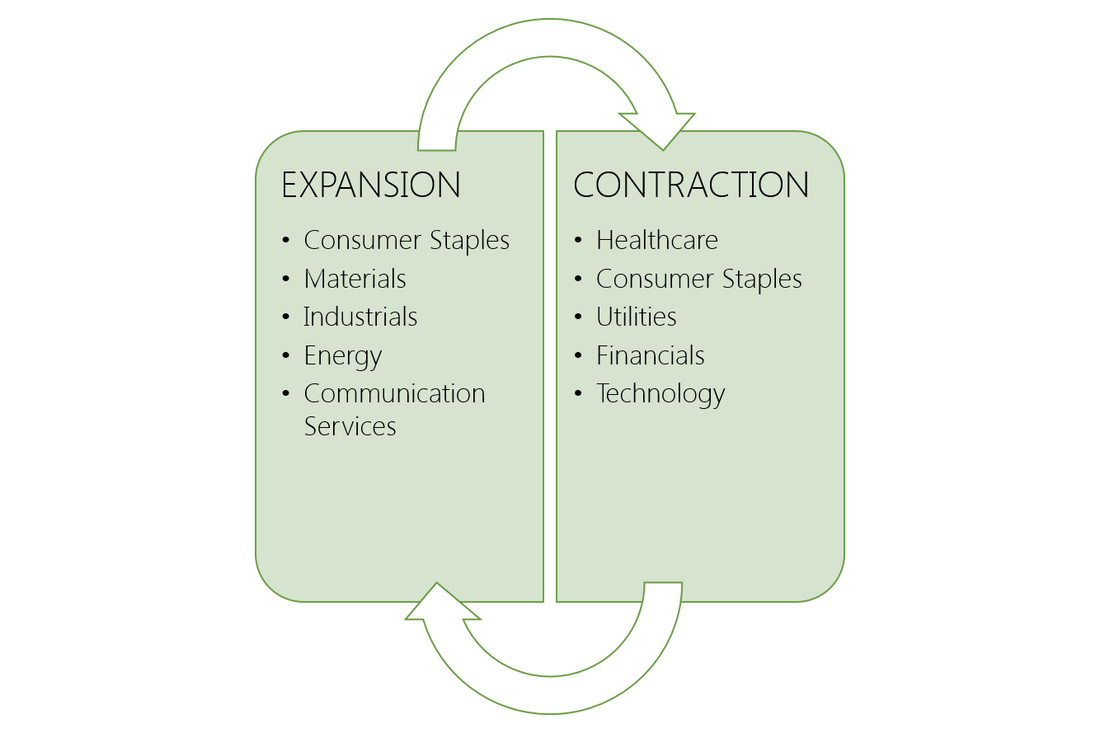

Sectors: walking or just talking? Most portfolio managers discuss markets within the context of the economic cycle. And no wonder: the main drivers of market performance – growth, inflation and interest rates – are not constants but fluctuate with the economic cycle. Managers point to their stock selection decisions because a particular company is seen as “cyclical” or “defensive”. In theory, cyclical companies do relatively better when the economy is expanding. Defensive companies do relatively better when the economy is slowing or contracting. But despite talking the talk on sectors when analysing the economic outlook, it’s harder to judge whether or not managers are walking the walk when it comes to sector investing. If your portfolio manager is not providing a sector allocation in their reporting back, perhaps ask for one. What exactly is a sector? A sector is a group of companies which provide the same or related product or service. The most broadly use classification system is the Global Industry Classification Standard (“GICS”) which categorises companies into 11 distinct sectors. GICS further defines 69 industry types that fall within each of those sectors. Cyclical or Defensive? When a company’s earnings are dependent on or more correlated with the broader economic business cycle, they are “cyclical”. When a company’s earnings are independent of or less correlated with the broader economic business cycle, they are defensive as in theory are less impacted by downswings in the economy. The list of sectors includes sectors considered “cyclical” such as: Communication Services, Consumer Discretionary, Financials, Industrials, Materials, and Technology; and sectors considered “defensive” sectors such as: Consumer Staples, Energy, Health Care, Utilities and Real Estate. Sector indices Sector indices calculate the performance of, typically, the combined market capitalisation of each distinct sector. In this way we are able to see the performance of each sector at different stages of the economic cycle on a standalone basis, in comparison with other sectors, and relative to the overall equity market. Why use a sector lense? By looking both the economy AND the market through a sector lense it is possible to analyse how groups of companies with commonalities as regards their input (expenses) and output (revenues) behave relative to their peers to inform comparisons within each sector, and comparisons between sectors over different time frames. This helps us understand the impact the economy has on sector-specific drivers, and which sectors could be in favour or out of favour at different stages of the economic cycle. Understanding the economic cycle The economic cycle (a.k.a business cycle) is the fluctuation in economic growth rates over time as measured by real (inflation adjusted) Gross Domestic Product as measured by national statistic offices. The economic cycle can be broken down into two broad states: expansion (trend of economic growth) and recession (trend of economic decline). Expansions are measured from the trough (or bottom) of the previous economic cycle to the peak of the current cycle, while recession is measured from the peak to the trough. The economic is different from the market cycle (the fluctuation of the equity markets over time), although one can impact the other. What drives sector performance? Economic activity changes at different changes in the cycle. In periods of expansion, consumers are more likely to increase their non-essential discretionary spending – so Consumer Discretionary should do better. In periods of recession, consumers are more likely to hunker down and focus only on essential spending – so Consumer Staples and Utilities should do better, for example. This seems intuitive. Furthermore, research suggests that more specifically it is the role of monetary policy that really drives sector performance. Central Banks adapt monetary policy based on the economic cycle. When monetary policy is easing, cyclical stocks do generally better. When monetary policy is tightening, defensive stocks generally do better. Surfing the cycle Given the economic cycle and monetary policy are in flux, it follows that an investor with a strategic allocation to equities should dynamically allocate to different sectors at different stages of the cycle, rotating from cyclicals to defensives and back again as the economic cycle fluctuates. This sector rotation strategy can earn “consistent and economically significant excess return while requiring only infrequent rebalancing”. Accessing sectors All equities fall within a sector grouping. Investors must therefore decide whether they wish to construct a portfolio of stocks within each sector or have a fairly concentrated holding within each sector. For investors that want to maximise diversification within each sector, a sector ETF is a convenient way of accessing targeted and comprehensive exposures to distinct sectors. Sector investing Whether investing in a particular sector to capitalise on specific sector trends, or seeking to implement a dynamic allocation strategy between sectors over the economic cycle with an equity allocation, sector ETFs offer a low-cost and convenient way of implementing cyclical sector views efficiently and precisely. Notices and Disclaimers: Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. Additional disclosure: Recently published Elston ETF Research reports “Sector Equities: 4q18 Update” and “Sector Equities: 4q18 Survey” were sponsored by State Street Global Advisors Limited. We warrant that the information in this article is presented objectively. For further information, please refer to important Notices and Disclosures please see our website www.ElstonETF.com This article has been written for a UK audience. Tickers are shown for corresponding and/or similar ETFs prefixed by the relevant exchange code, e.g. “LON:” (London Stock Exchange) for UK readers. For research purposes/market commentary only, does not constitute an investment recommendation or advice, and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product. This article reflects the views of the author and does not necessarily reflect the views of Elston Consulting, its clients or affiliates. For information and disclaimers, please see www.ElstonETF.com Photo credit: N/A; Chart credit: Elston Consulting; Table credit: Elston Consulting Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed