|

[7 min read, open as pdf for full report]

[See CPD webinar on risk-weighted diversification]

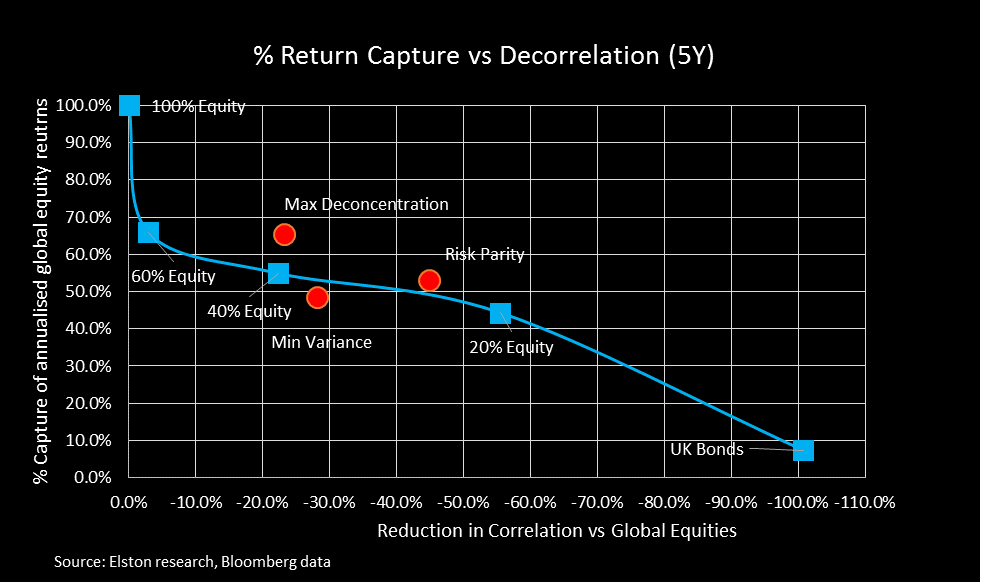

The challenge A 60/40 portfolio delivers asset-based diversification: it represents a mix between equities and bonds. However although a 60/40 portfolio reduces market beta, it does not provide “true” (risk-based) diversification: for example, a 60/40 portfolio, as represented by the Elston 60/40 GBP Index remains 97% correlated with Global Equities. This problem only increases in stressed markets where correlations between assets increase, as we saw in 2020. Risk-weighted strategies for “true” diversification Risk-weighted stratetgies, which represent multi-asset portfolios constructed towards a specific portfolio risk outcome, enable an alternative, differentiated approach to investing and for incorporating "true“diversification”. We look at the following risk-based strategies in our analysis: Risk Parity, Max Deconcentration, and Min Variance. These are summarised in more detail in the report. Comparing asset-weighted vs risk-weighted strategies How can we compare the efficacy of traditional asset-weighted strategies (e.g. 20%, 40%, and 60% equity/bond strategies), vs these risk-weighted strategies? One approach would be to compare the efficacy of risk-based strategies vs asset-based strategies from the perspective of 1) capturing equity returns, whilst 2) providing “true” diversification as measured by decorrelation impact (the reduction in correlation relative to global equities). In summary, the findings are that a Risk Parity strategy captured a similar level of equity returns as a 40% equity strategy, but with almost twice the level of decorrelation, meaning it delivers far greater “true” diversification relative to an asset-weighted strategy with similar return profile. Over the 5 years to December 2020, a 40% Equity strategy captured 44.3% of global equities annualised returns and delivered a correlation reduction of -22.3%. By contrast, a Risk Parity strategy captured 48.5% of global equity reutrns, and delivered a decorrelation of -44.8%, relative to global equities. So for portfolio constructors looking to deliver “true” risk-based diversification, whilst maintaining exposure to risk assets for the potential for returns, incorporating a risk-based strategy such as Risk Parity, Max Deconcentration, or Min Variance could make sense depending on portfolio risk budgets and preferences. For full quarterly performance update, open as pdf Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed