|

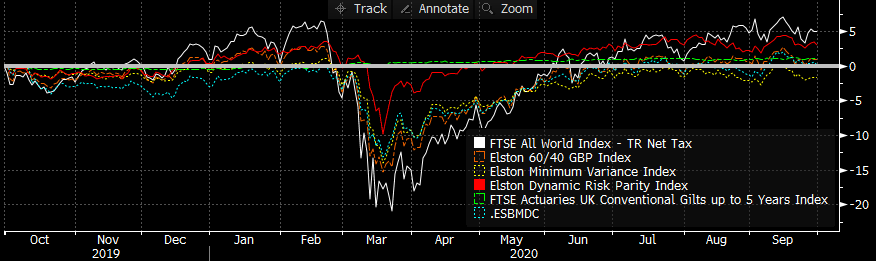

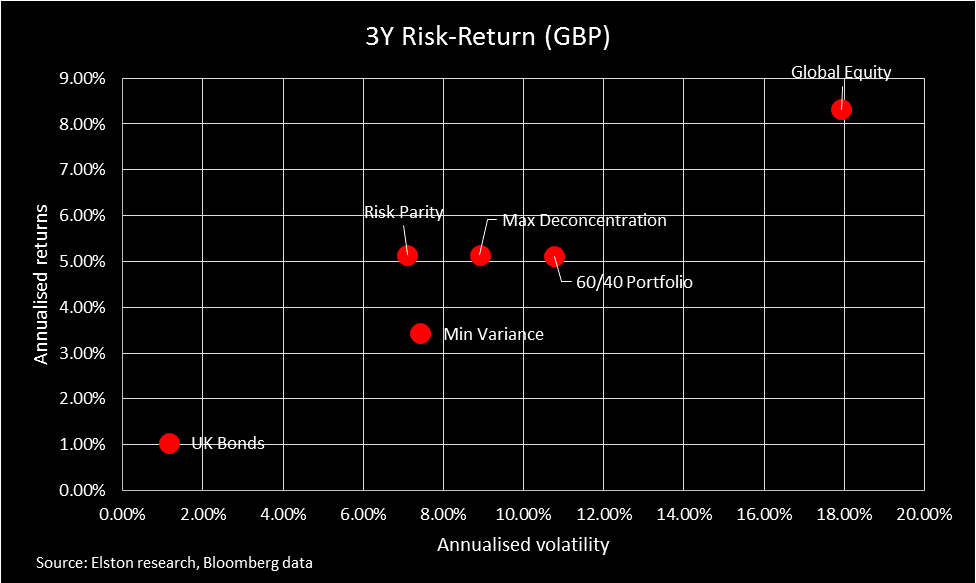

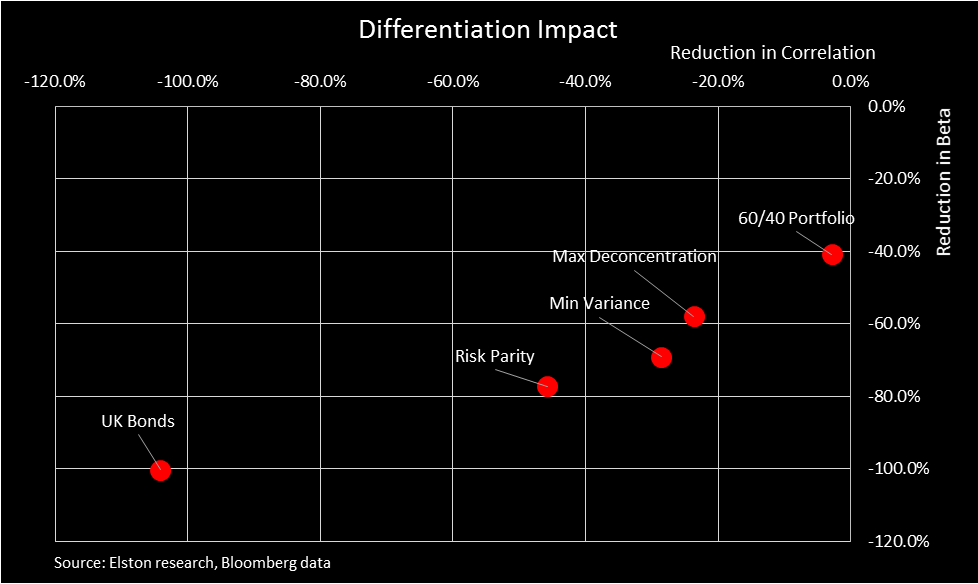

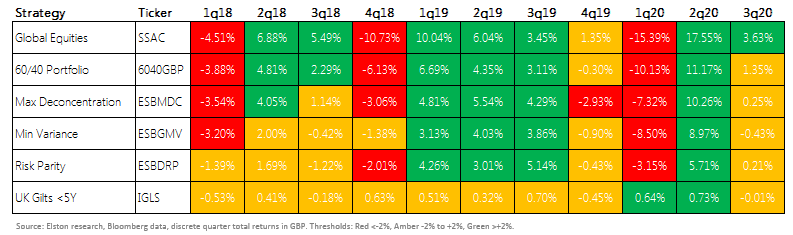

[2 min read. Buy the full report] We compare the performance of risk-weighted multi-asset strategies relative to a Global Equity index and our Elston 60/40 GBP Index, which reflects a traditional asset-weighted approach. Of the risk-weighted strategies, Elston Dynamic Risk Parity Index delivered best -1Y total return at +3.03%, compared to +5.01% for global equities and +0.95% for the Elston 60/40 GBP Index. Source: Bloomberg data, as at 30/09/20 On a risk-adjusted basis, Risk Parity delivered a -1Y Sharpe Ratio of 0.27, compared to 0.18 for Global Equities, meaning Risk Parity delivered the best risk-adjsuted returns for that period. Risk Parity also delivered greatest differentiation impact of the risk-weighted strategies with a -45.8% reduction in correlation and -77.3% reduction in beta relative to Global Equities. This enables "true diversification" whilst maintaing potential for returns. By contrast the Elston 60/40 Index, whilst successfully reducing beta by -40.9%, delivered a correlation reduction of only -2.9%. Put differently, a traditional 60/40 portfolio offers negligbile diversification effect in terms of risk-based diversification through reduced correlation. The periodic table shows lack of direction amongst risk-weighted strategies in the quarter. All data as at 30th September 2020

© Elston Consulting 2020, all rights reserved Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed