|

Investors often seek out differentiated risk-return assets for inclusion within a portfolio for diversification purposes.

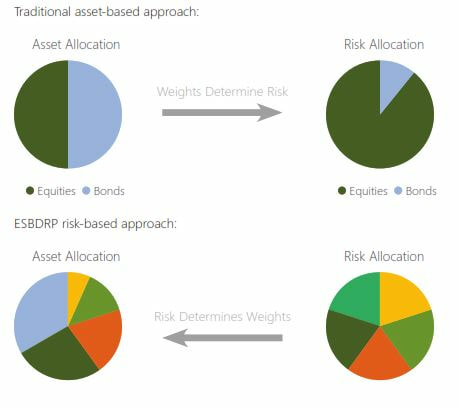

This is often the rationale used for inclusion of hedge funds, absolute return funds, diversified growth funds, and real assets in a portfolio. An alternative approach But is there an alternative way of achieving differentiation? We believe so. Risk-based strategies are multi-asset strategies that are designed to be differentiated. Examples of multi-asset risk-based strategies include: Minimum Variance, Risk Parity, Maximum Deconcentration, Maximum Sharpe and Maximum Decorrelation. These strategies target a particular risk objective and that risk objective drives the underlying asset weightings. Has it worked? On a rolling 5 year basis to end 2019, both multi-asset Min Volatility and Risk Parity delivered in providing both lower beta to, and reduced correlation with Global Equities, relative to a 60/40 portfolio, as well as delivering on their stated objectives. Relative to global equities with a Beta of 1, a 60/40 strategy, a multi-asset Min Variance strategy and Risk Parity provide a -40.4%, -68.8% and -75.3% reduction in beta respectively. Relative to global equities (correlation = 100%), a 60/40 strategy, a multi-asset Min Variance and Risk Parity provide -5.7%, -32.2% and -45.3% reduction in correlation respectively. This highlights that although a 60/40 approach reduces beta, it doesn't much reduce correlation. For an effective decorrelation approach to achieve true diversification, a risk-based approach to multi-asset investing provides a helpful diversifier. Risk-based strategies are a portfolio construction approach and can be delivered using liquid ETFs with no leverage and no shorting. We expect to see a growing role for multi-asset risk-based strategies within portfolios given their transparency, liquidty, and cost advantage relative to hedge funds and absolute return funds. We believe that systematic strategies that are designed to be different are more likely to be different than strategies that are hoped to be different. After all, portfolio construction is just maths. Get the full report For the analysis: Global Equities proxy: iShares MSCI ACWI UCITS ETF [Ticker: SSAC LN Equity] 60/40 strategy: Elston 60/40 Index (GBP) [Ticker GBP6040 Index] Multi-asset Min Variance strategy: Elston Min Variance Index (GBP) [Ticker ESBGMV Index] Multi-asset Risk Parity strategy: Elston Risk Parity Index (GBP) [Ticker ESBDRP Index] Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed