|

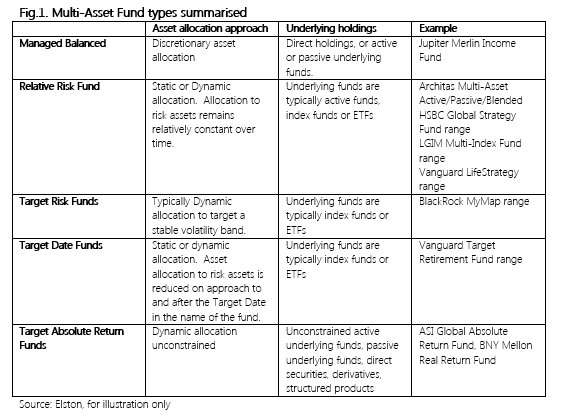

[7 min read, open as pdf] Whether or not investors enjoy creating and managing their own ETF portfolios, ready-made portfolios and funds of ETFs and index funds offer a convenient alternative In this series of articles, I look at some of the key topics explored in my book “How to Invest With Exchange Traded Funds” that also underpin the portfolio design work Elston does for discretionary managers and financial advisers. Who needs or wants a ready-made portfolio? Individual investors of all wealth levels may find the prospect of engaging with their investment daunting, time-consuming, or both. This is heightened by the high number of investment products and services available. In the UK, there are over 70 discretionary management firms, and over 3,000 investment funds and ETFs. For this reason, DIY investors may want ready-made portfolios that are an easy-to-buy and easy-to-own investment. Not only do these solutions look like a simple alternative but they can also address and can potentially mitigate behavioural mistakes. We look at three alternative ways of delivering ready-made portfolios for DIY investors in more detail: multi-asset funds, ETF portfolios and multi-asset ETFs. Multi-Asset Funds Multi-Asset Funds (also known as Asset Allocation Funds or Multi-Manager Funds) are the most established type of ready-made portfolios. By owning a single fund (or in some cases an investment trust), investors get exposure to a diversified portfolio of underlying funds to reflect a specific asset allocation. This means that having selected a strategy, the investor does not need to worry about asset allocation, or about the portfolio construction to achieve that asset allocation, or about security selection within each asset class exposure. We categorise Multi-Asset Funds into different categories by investment strategy:

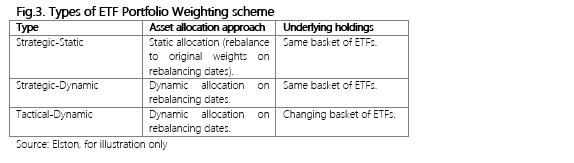

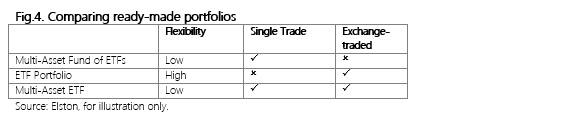

Despite the cost of wrapping underlying funds within a fund structure, economies of scale mean that Multi-Asset Funds can be delivered to investors at highly competitive price points with very low minimums. However, the disadvantage is that Multi Asset Funds have a one-size-fits-all approach that means there is little scope for customisation to the individual needs and characteristics of the investor’s objectives and constraints. ETF Portfolios ETF Portfolios are basket of individual ETFs providing an asset allocation. Rather than wrapping an investment strategy within a fund, a model portfolio is made available as a basket of ETFs that can be bought individually to create the strategy. Model portfolios may be “strategic” (rebalanced to fixed weights of the same securities) or “tactical” (rebalanced to changing weights of the same or different ETFs). Model portfolios are research portfolios meaning that the model portfolio provider has no control of client assets so it is up to a portfolio manager, adviser or DIY investor to implement any changes should they wish to follow a given model portfolio strategy. The advantages of ETF Portfolios include: firstly, potentially lower fees owing to removal of a fund wrapper to hold the strategy; secondly greater flexibility and specificity with regards to asset allocation design; and lastly agility as strategies can be launched or closed with ease. An example of an ETF Portfolio could be as simple as a classic global 60/40 Equity/Bond strategy constructed with ETFs. Whilst ostensibly very simple – a two security portfolio – the underlying holdings of each ETF means that investors get exposure to 3,133 equities in global and developed markets (approximately 47 countries) and 1,660 investment grade bonds in over 24 countries. Put simply, the investor is able to buy the bulk of the global equity and bond markets with two simple trades. When manager, advisers or research firms create model portfolios, the weighting scheme can be one of three types as summarised in the table below. The ability to design and create ETF Portfolios with an increasing number of ETF building blocks means that both traditional (asset managers, stock brokers) and non-traditional providers (e.g. trade publications, investment clubs, industry experts) can create investment strategies that can be “followed” by investors. However, the usual due diligence rules for any investment provider should be applied as regards their investment process. Whilst the rise of more bespoke ETF strategies is welcome, the convenience of having a single strategy delivered as a single security from a portfolio construction perspective is attractive. This is where Multi-Asset ETFs could have a role to play. Multi-Asset ETFs Multi-Asset ETFs are an emerging way of delivering the returns of a managed ETF Portfolio using a single instrument. Whereas multi-asset funds are often funds of index-tracking funds, Multi-Asset ETFs can be viewed as an “ETF of ETFs”. In the US, there are a number of multi-asset ETFs available providing a ready-made allocation within a single trade. In the UK, there are currently only two ranges of multi-asset ETFs available. Multi-Asset Infrastructure (launched April 2015) SPDR® Morningstar Multi-Asset Global Infrastructure UCITS ETF ESG Multi-Asset ETFs (launched September 2020) BlackRock ESG Multi-Asset Conservative Portfolio UCITS ETF (MACG) BlackRock ESG Multi-Asset Moderate Portfolio UCITS ETF (MAMG) BlackRock ESG Multi-Asset Growth Portfolio UCITS ETF (MAGG) We expect multi-asset funds, constructed with ETFs and index funds, to gain more traction than multi-asset ETFs because as a “buy and hold” ready-made portfolio multi-asset funds do not need the intraday dealing availability that ETFs provide. Multi-asset funds (constructed with index funds/ETFs), ETF Portfolios, and Multi-asset ETFs provide a ready-made one stop for delivering a multi-asset investment strategy for all or part of an investment portfolio, whether defined by a multi-asset index or not. The advantages of a multi-asset fund of ETFs as a ready-made portfolio The advantages of a “one and done” approach include collectivisation, convenience and consistency. Firstly, is collectivisation of investor’s by objective which creates cost efficiency from the economies of scale. Adopting a collectivised approach, can be done where each group of clients shares the same goal (as defined by, for example, a target risk level or income objective, or volatility objective or target date). This can help achieve economies of scale and lower the cost of offering professionally managed asset allocations in at least three different ways. Firstly, each cohort becomes a multi-million pound ‘client’ of an asset manager who can deploy institutional-type bargaining power on the pricing of the underlying funds within their asset allocation. Secondly, the collective scale reduces frictional trading costs of implementing the asset allocation decisions: one managed investment journey is more efficient to manage and deliver than thousands of individual ones. Finally, by focusing on actively managing the asset allocation as the main determinant of the level and variability of returns[1] the asset allocation can be implemented with index-tracking ETFs to keep costs down. Secondly is convenience. Rather than focusing solely on building optimal multi-asset class portfolios that need monitoring, the proposition of investment offerings can be engineered to eliminate poor behavioural tendencies that prevent effective management. Engineering funds so that they offer a single investment journey which investors do not necessarily need to monitor regularly in order to reach their goals can help reduce the perceived hassle of investing. This can motivate individuals to invest. Such professionally managed funds prevent investors from either not rebalancing the portfolio or doing it in an improper fashion due to behavioural tendencies such as status quo bias[2] and disposition effect[3]. Furthermore, a professionally managed strategy can respond to other risks aside from market risk such as shortfall, concentration or longevity risks which lay investors can overlook. An additional advantage of offering managed diversified funds is that it automatically curtails the number of products offered, thereby reducing cognitive load of making an investment decision and can prevent decision deferral.[4] Finally is consistency. Investors in each strategy experience the same time-weighted investment returns thereby reducing the likely dispersion of returns that a group of investors would experience through an entirely self-directed approach. This consistency is why multi-asset funds have also been adopted by some financial advisers as a core or complete holding within a centralised investment proposition. The disadvantage of a ready-made portfolio are not secret. They are designed as a “one-size-fits-all” product with no scope for customisation. The respective features of the various types of ready-made portfolio are set out below. Whereas multi-asset funds of ETFs, and multi-asset ETFs can be accessed via a single trade, their scope for customisation is low. ETF Portfolios have the highest degree of flexibility for creating custom strategies, but are not accessible via a single trade. Summary Ready-made portfolios are easy to buy and easy to own. They enable a “set and forget” approach to investment management which can help design out key behavioural risks, or provide a useful core holding to a broader strategy. Obviously the primary choice is which strategy an investor must choose, or their adviser should recommend depending on their risk-return objectives and suitability considerations. [1] Ibbotson, “The Importance of Asset Allocation.” [2] Samuelson and Zeckhauser, “Status Quo Bias in Decision Making.” [3] Shefrin and Statman, “The Disposition to Sell Winners Too Early and Ride Losers Too Long”; Weber and Camerer, “The Disposition Effect in Securities Trading.” [4] Iyengar and Jiang, “How More Choices Are Demotivating”; Iyengar, Huberman, and Jiang, “How Much Choice Is Too Much?” Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed