|

[3 min read, open as pdf]

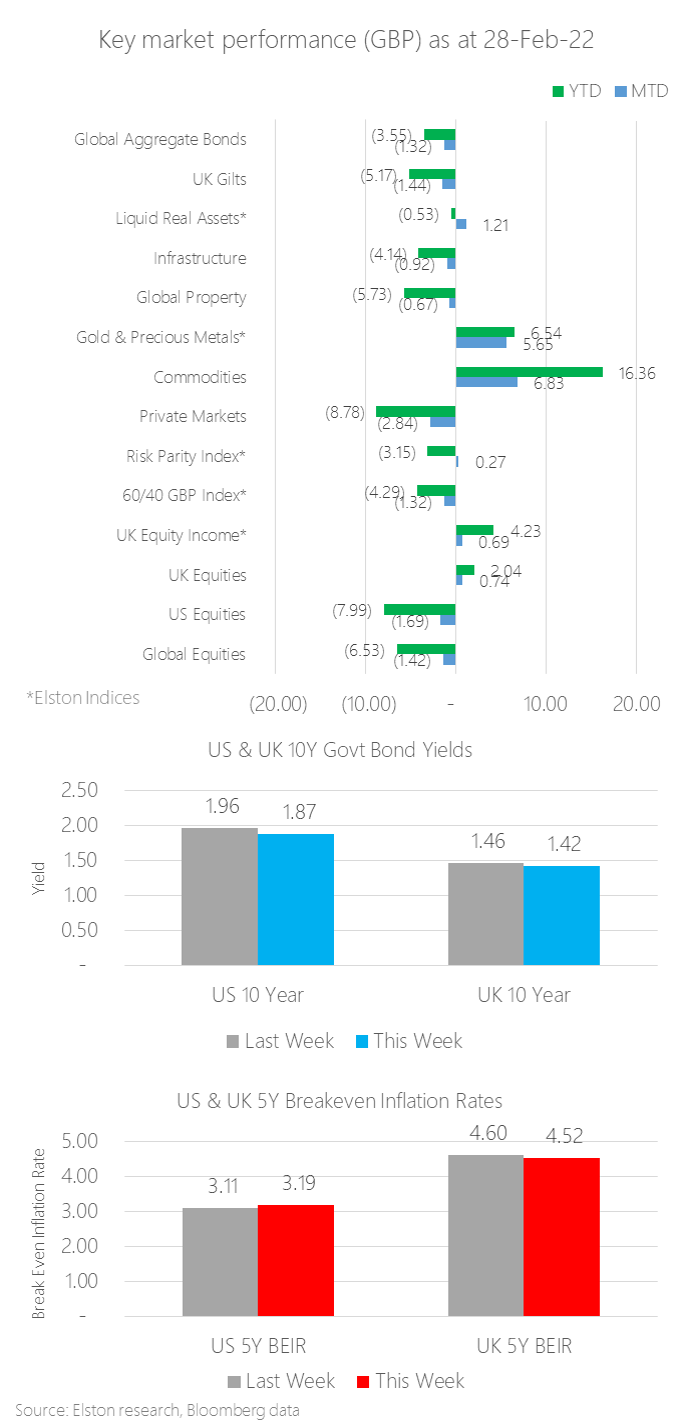

Monthly update Commodities was the top performing asset class in February, returning +6.83% in GBP terms, on inflation fears and energy crisis- exacerbated by political risk resulting from Russia’s invasion of Ukraine. Fears of the first European land war since the 1990s also drove demand for Gold as a safe-haven asset and inflation hedge. Our Gold & Precious Metals index – a composite of predominantly gold, but also silver, platinum and palladium – increased +5.65% MTD in GBP terms. Within equities, UK equities continued to outperform US and global equities owing to the inherent value bias. Our Liquid Real Assets index returned +1.21% for the month, compared to Gilts -1.44%. Within the multi-asset space, our “Equal Risk” or Risk Parity Index returned +0.27%, compared to -1.32% for a traditional 60/40 portfolio. US & UK 10 year yields closed at 1.87% and 1.42% respectively US & UK 5 year market-implied Break Even Inflation Rates closed at 3.19% and 4.52% respectively. Our granular asset-level report is updated in our Quarterly Review and Outlook after each March, June, September and December quarter end. Market performance The month-end market performance snapshot is summarised in the chart below. For latest commentary, please refer to our Insights and weekly Friday Insights email. Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed