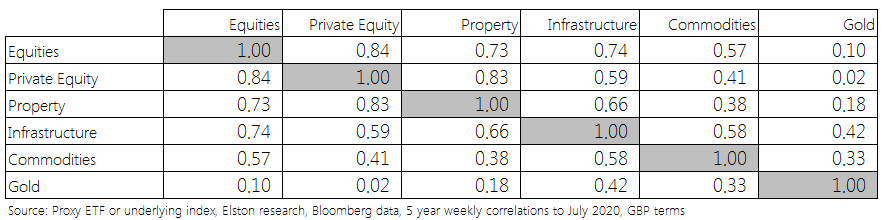

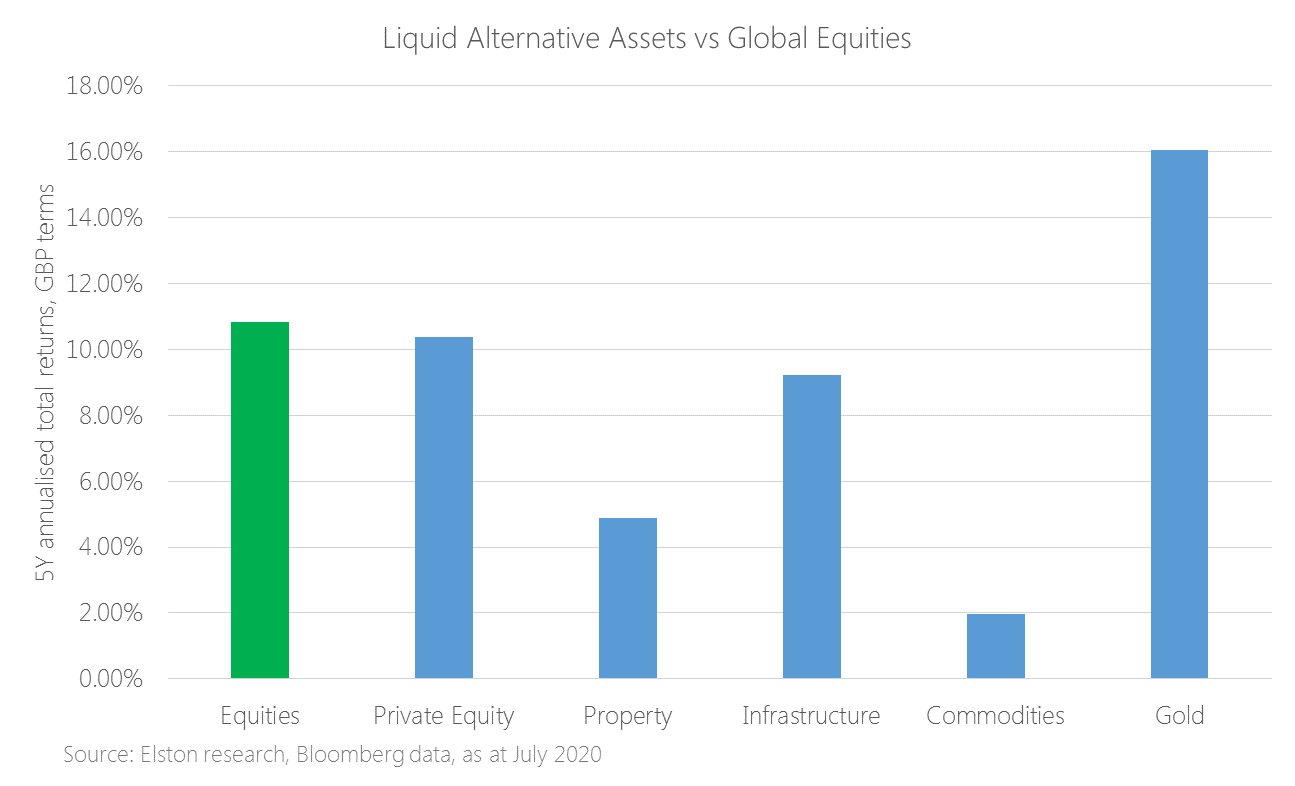

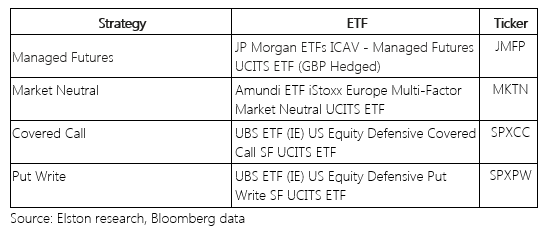

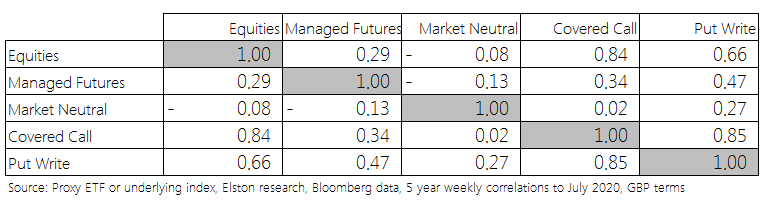

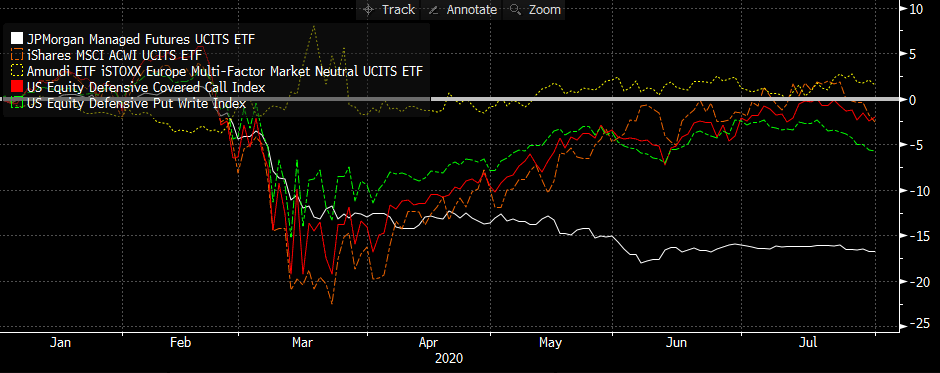

Liquid Alternatives: Assets We define Liquid Alternative Asset ETFs as tradable ETFs that hold liquid securities that provide access to a particular “alternative” (non-equity, non-bond) asset class exposure. More specifically, we define this as Listed Property Securities, Infrastructure Securities, Commodities, Gold and Listed Private Equity. Looking at selected ETF proxies for each of these asset classes, the correlations for these Liquid Alternative Assets, relative to Global Equity are summarised below. Fig.1. Liquid Alternative Assets: Correlation Matrix Incorporating these exposures within a multi-asset strategy provides can provide diversification benefits, both from an asset-based perspective and a risk-based perspective. Looking at 5 year annualised performance, only Gold has outperformed Global Equities. Listed Private Equity has been comparable. Meanwhile Infrastructure has outperformed property, whilst Commodities have been lack-lustre. Fig.2. Liquid Alternative Assets Returns vs Global Equities Looking at performance YTD, gold has returned +31.06% in GBP terms, outperforming Global Equities by 32.54ppt. Infrastructure has also slightly outperformed equities owing to its inflation protective qualities. Fig.3. YTD performance of Liquid Alternative Assets (GBP terms) Source: Elston research, Bloomberg data Liquid Alternatives: Strategies We define Liquid Alternative Strategy ETFs as tradable ETFs that provide alternative asset allocation strategies. By providing differentiated risk-return characteristics, these ETFs should provide diversification and/or reflect a particular directional bias. Fig.4. Examples of European-listed Liquid Alternative Strategies Each of these strategies provide a low degree of correlation with Global Equities and therefore have diversification benefits. Fig.5. Liquid Alternative Strategies: Correlation Matrix In 2020, the Market Neutral strategy has proven most defensive. Fig.6. Liquid Alternative Strategies: YTD performance Source: Bloomberg data, GBP terms, as at July 2020 Conclusion ETFs offer a timely, convenient, transparent, liquid and low-cost way of allocating or deallocating to a particular exposure. Blending Liquid Alternative ETFs – both at an asset class level and a strategy level - provides managers with a broader toolkit with which to construct portfolios. NOTICES

Commercial Interest: Elston Consulting Limited creates research portfolios and administers indices that may or may not be referenced in this article. If referenced, this is clearly designated as such and is to raise awareness and provide purely factual information as regards these portfolios and/or indices. Image Credit: Shutterstock Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed