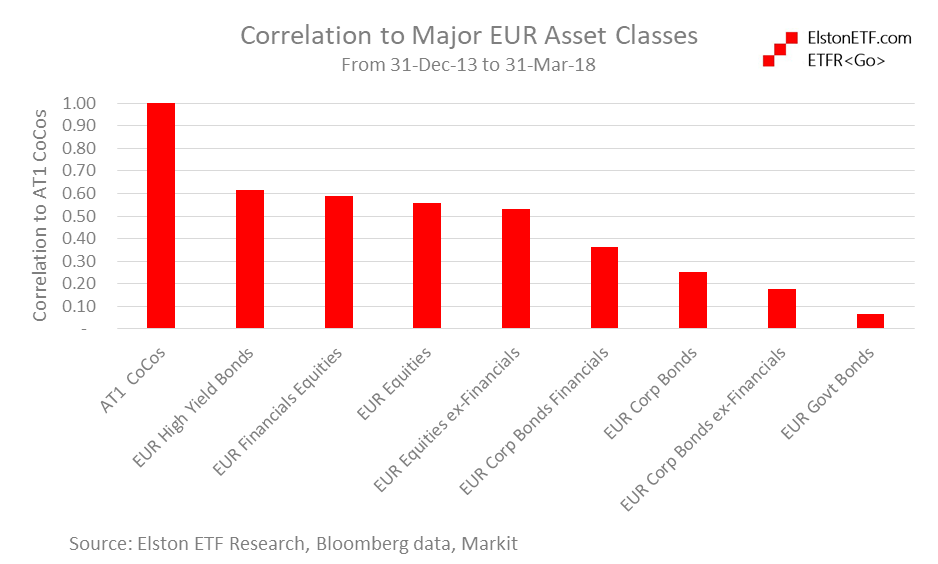

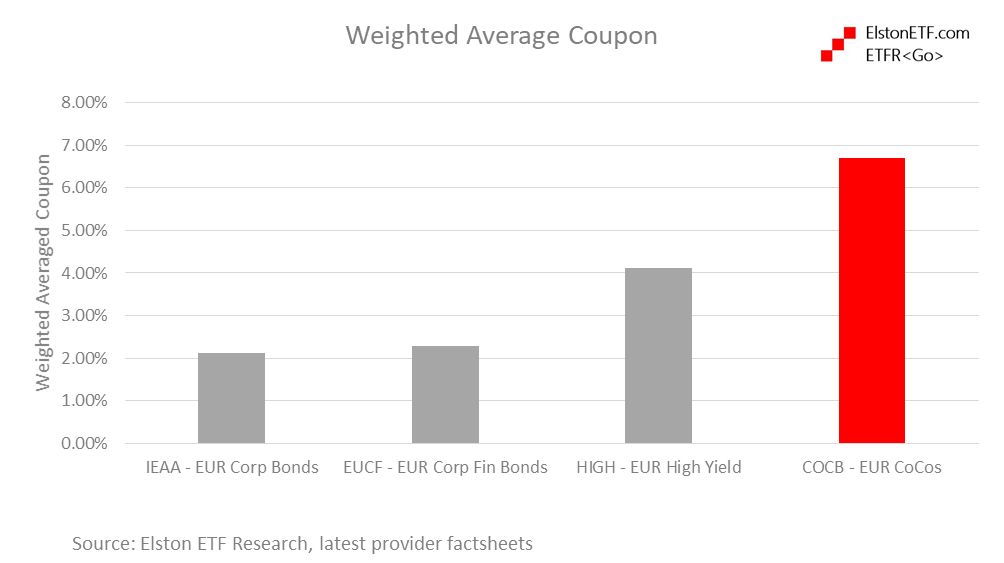

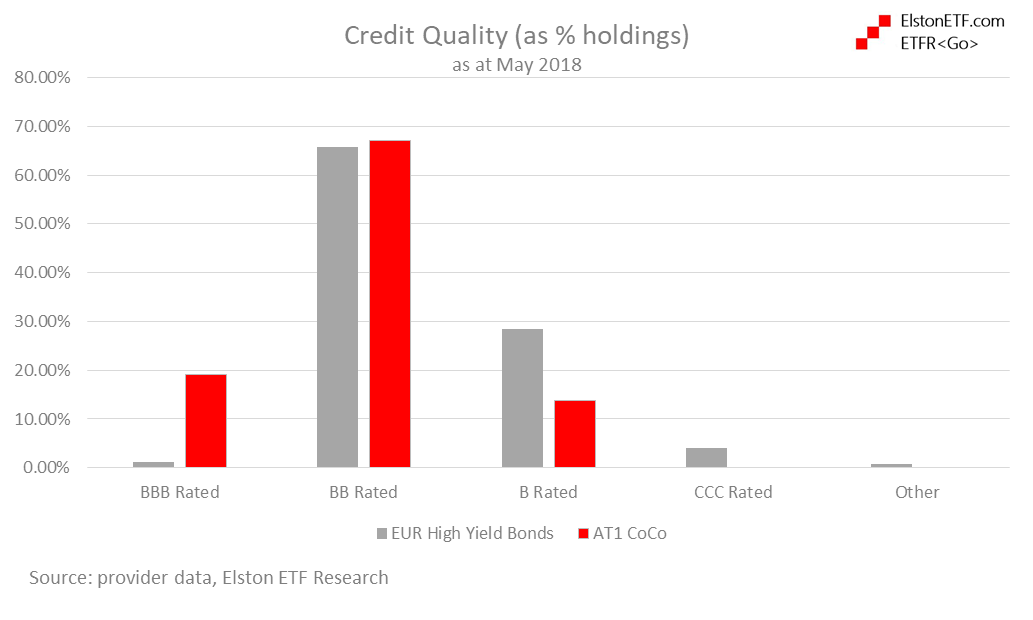

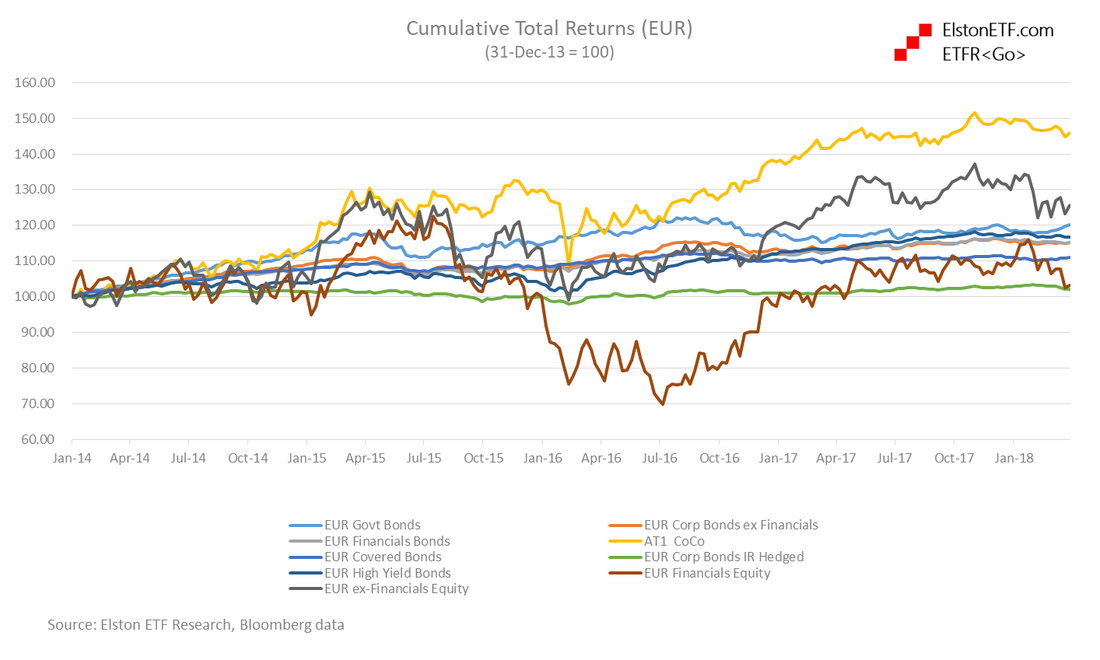

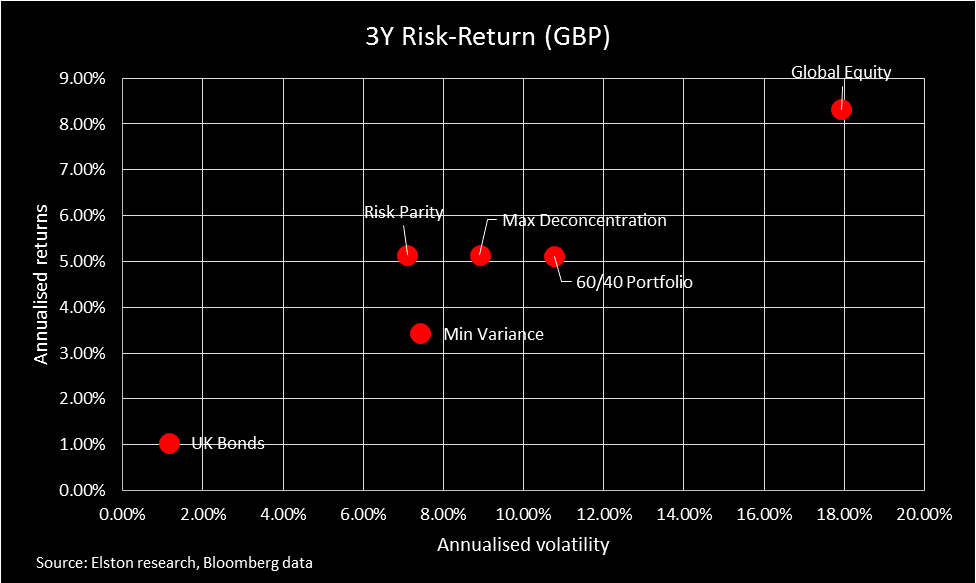

What are CoCos? Following the 2008 financial crisis, banks had difficulty issuing traditional debt securities, and had to sit on a large amount of capital to ensure their balance sheet strength was maintained. CoCos were created as the issuing banks flexible friend. This is because are designed to absorb losses when the balance sheet of the issuing banks weakens below a threshold level. Losses can be absorbed by the CoCo converting into equity or suffering a write-down of its principal value making it more flexible than traditional bank securities. To offset the risk of loss, CoCos are issued with a higher coupon than traditional bank bonds. Accessing CoCos Whilst bond funds may include CoCos, direct access to CoCos as a targeted allocation was previously only available to institutions who could meet minimum issuance sizes from one or more issuer. By accessing CoCos using an ETF, the minimum investment drops to $100, and the ETF is diversified across 29 CoCos from 24 different issuers. Why include CoCos in a portfolio? Convertibility into the issuing bank’s shares means that CoCos provide an exposure that has both bond and equity-like characteristics. When there is higher risk of balance sheet stress, CoCo's behave more like equities. When there is lower risk of balance sheet stress, CoCo’s behave more like bonds. CoCos' moderate correlation to equities and low correlation to Corporate and Government Bonds makes them a useful diversifier from a portfolio construction perspective. Fig.1. Correlations to major asset classes Bigger income & better credit quality CoCos have an attractive income to reward risk taken, but a better quality credit rating compared to traditional High Yield Bonds. Fig.2. Income Profile Fig.3. Credit Profile Furthermore, in terms of counterparty risk, CoCos are only issued by large banks that are well regulated with high capital ratios. How about performance? CoCos have outperformed EUR bonds and equities, both excluding and including Financials exposure. Fig.4. Total Returns CoCos are positioned between equities and bonds in respect of realised volatility, but with better risk-adjusted returns. Fig.5. Risk-Return In summary, CoCos have offered solid risk-adjusted returns (Sharpe Ratio), and have a low correlation to bonds from a diversification perspective and a higher income with better credit quality relative to traditional high yield bonds.

Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed