|

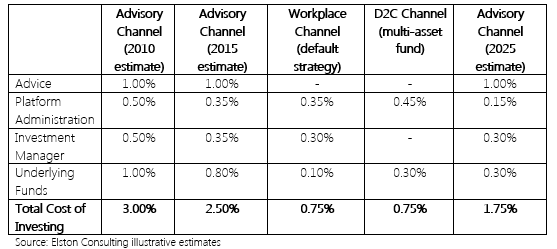

[7 min read, open as pdf] Fee pressure is here to stay. In the “race to the client” being run by platforms, DFMs and fund houses, it’s up to advisers to rethink their business model, and make sure they stay in the lead. In this series of articles, I look at some of the key topics explored in my book “How to Invest With Exchange Traded Funds” that also underpin the portfolio design work Elston does for financial advisers. Fee pressure is here to stay Between competition, regulation and ultra-low interest rates, there is understandable and justified pressure on costs. Looking at the overall “value chain” – the cost of advice, platform, discretionary manager, and underlying funds – means that without careful scrutiny, investing a pension or an ISA ends up meaning its client money risked for the financial service industry’s reward. With these “all-in” costs sometimes as high as 2.50%-3.00%, the situation is untenable, particularly when contrasted with non-advised workplace pensions and non-advised d2c solutions that can deliver a manager multi-asset investment solution at an all-in (excluding advice) cost of 0.50-0.75%. Put simply, if we imagine a price anchor/price cap of 0.75% for workplace and pathway-style non-advised investments, there is effectively a soft-price cap of 1.75% for advised investments, in our view, from a Value for Money perspective. MiFID II has been a tremendous driver of total cost transparency, and has sharpened the minds, and the pencils, of clients and advisers alike. The cost of delivering investment solutions (excluding advice) differs vastly depending on whether accessed via advised, workplace and non-advised channels (see Fig.1.). This is not sustainable. Changing landscape

Given the inevitability of fee pressure and a steadily shrinking pie, there are three key trends emerging:

The Race to the Client Sustained fee compression across the value chain, means that there is a growing awareness amongst providers within the industry that their position in the value chain can be commoditised. That’s why there is so much corporate activity and proposition change from all the different parties within the value chain. Fund houses are investing in platforms, platforms are setting up advice firms, and advice firms are setting up DFMs. All of these parties are afraid of watching their products or services being commoditised, and hence many want to move to a vertically integrated model. I call this the “Race to the Client”. And yet at the end of the day, there is only relationship that matters and that cannot be commoditised. And that’s one of trust and personality which makes up the relationship between the adviser and their client. Control of the value chain: who has the power? Whilst some fund houes see advisers as “Distributors”, the truth is now the opposite. Instead of being price takers, advisers are becoming price setters. In the race to the client, advisers are and should aim to stay in the lead. But only if they take control of the value chain and align it to their clients’ best interests. Next generation advisers are no longer fund pickers, or model pickers, or manager pickers: they are fiduciaries who owe a duty of care to their clients and help them navigate the maze of financial services to ensure good customer outcomes, and excellent value for money. The institutionalisation of retail As workplace schemes become more individualised, and individual schemes become more mass-market, the retail and institutional worlds are beginning to collide, and this “institutionalisation of retail” means a focus on greater governance, increased professionalism, at substantially lower end-client costs. Strategic options for advisers Advisers have a number of options to compress all-in costs, whilst enhancing their business model.

Stop feeding the hand that will bite you The race to the client is hotting up, and is all too visible from the M&A activity in the sector, and the rush of private equity capital into the UK advice market. And yet many adviser firms seem determined to feed the hand that’s going to bite them. Why use a DFM whose stated aim is to cut you out of the value chain, and who spends more on Facebook ads, than your entire turnover? Why use a fund house whose billboards at every station reach out to your clients to go direct? Why use a platform that prefers to offer accounts to customers directly? Looking after clients is the most valuable part of an adviser business. Don’t give them away to your larger, bigger branded competitors. Summary As the race to the client hots up, the good news for advisers is that you are already in the lead. So stop feeding your competitors – the DFMs, the fund houses, the platforms, and take back control of the value chain to ensure you can protect clients’ best interests. © Elston Consulting Limited All Rights Reserved Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed