|

[2 minute read, open as pdf] Sign up for our upcoming webinar on incorporating ESG into model portfolios Summary

Defining terms With a growing range of ethical investment propositions available to portfolio designers, we first of all need to define and disambiguate some terms.

Criteria-based approach works well for indices Applying ESG criteria to a universe of equities acts as a filter to ensure that only investors are only exposed to companies that are compatible with an ESG investment approach. Creating a criteria-based approach requires a combination of screening, scoring and weighting. Looking at the MSCI World SRI 5% Capped Index, for example, means:

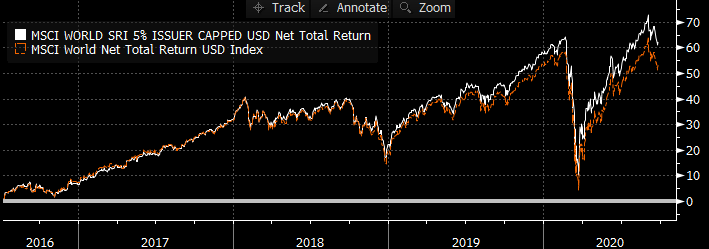

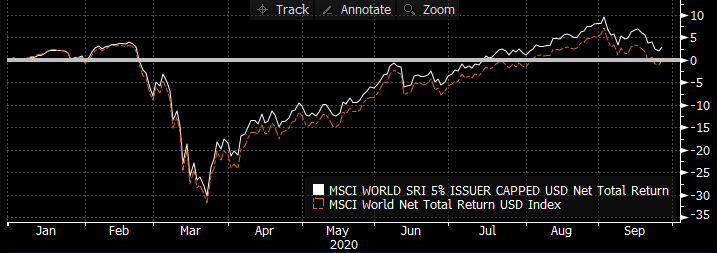

Indices codify criteria An index is “just” a weighting scheme based on a set of criteria. A common, simple index is to include, for example, the 100 largest companies for a particular stock market. SRI indices reflect weighting schemes, albeit more complex, but importantly, represent a systematic (rules-based) and hence objective approach. However, the appropriateness of those indices is as only as good as their methodology and the quality of the screening, scoring and weighting criteria applied. Proof of the pudding To mix metaphors, the proof of the pudding is in the making of performance that is consistent with the parent index, whilst reflecting all the relevant scoring and screening criteria. This allows investors to have their ESG cake, as well as eating its risk-return characteristics. Contrast, for example, the MSCI World Index with the MSCI World Socially Responsible Investment 5% Issuer Capped Index. The application of the screening and scoring reduces the number of companies included in the index from 1,601 to 386. But the weightings adjustments are such that the relative risk-return characteristics are similar: the SRI version of the parent index has a Beta of 0.98 to the parent index and is 99.4% correlated with the parent index. Fig.1. Comparative long-term performance Source: Bloomberg data Fig.2. Year to Date Performance Source: Bloomberg data,

Focus on compliance, not hope of outperformance Indeed pressure on the oil price and the performance of technology this year (technology firms typically have strong ESG policies) means that SRI indices have slightly outperformed parent indices. However, our view is that ESG investing should not be backing a belief that performance should or will be better than a mainstream index. In our view, ESG investing should aim to deliver similar risk-return characteristics to the mainstream index for a given exposure but with the peace of mind that the appropriate screening and scoring has been systematically and regularly applied. [1] For more on this ratings methodology, see https://www.msci.com/esg-ratings Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed