|

[3 min read, open as pdf]

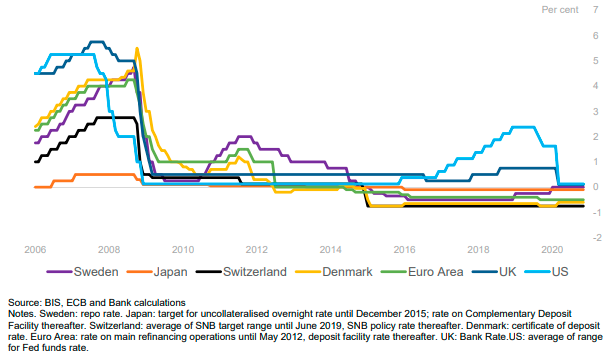

A “last resort” policy tool Zero & Negative Interest Rate Policy are Non-Traditional forms of Monetary Policy is a way of Central banks creating a disincentive for banks to hoard capital and get money flowing. Zero Interest Rate Policy (ZIRP) is when Central Banks set their “policy rate” (a target short-term interest rate such as the Fed Funds rate of the Bank of England Base Rate) at, or close to, zero. ZIRP was initiated by Japan in 1999 to combat deflation and stimulate economic recovery after two decades of weak economic growth. Negative Interest Rate Policy (NIRP) is when Central Banks set their policy rate below zero. Japan, Euro Area, Denmark, Sweden are currently using a NIRP. US & UK are currently using a ZIRP, and are considering a NIRP. Fig.1. Advanced economy policy rates Whilst bond prices may imply negative real yield, or negative nominal yields, a NIRP impacts the rates at which the Central Bank interact with the wholesale banking system and is intended to stimulate economic activity by disincentivising banks to hold cash and get money moving. A NIRP could translate to negative wholesale rates between banks, and negative interest rates on large cash deposits, but not necessarily retail lending rates (e.g. mortgages).

Ready, steady, NIRP Negative Interest Rates were used in the 1970s by Switzerland as an intervention to dampen currency appreciation. . It was the subject of academic studies and was seen as a last resort Non-Traditional Monetary policy during the Financial Crisis of 2008 and during the COVID crisis of 2020. Sweden adopted NIRP in 2009, Denmark in 2012, and Japan & Eurozone in 2014. The Fed started looking closely at NIRP in 2016. According Bank of England MPC minutes of 3rd March 2021, wholesale markets are generally prepared for negative interest rates as have already been operating in a negative yield environment. By contrast, retail banks may need more time to prepare for negative interest rates to consider aspect such as variable mortgage rates. There are arguments for and against NIRP. The main argument for is that NIRP is stimulatory. The main argument against is that NIRP failed to address stagnation and deflation in Japan and can create a “liquidity trap” where corporates hoard capital rather than spend and invest. The hunt for yield With negative interest rates, there will be an even greater hunt for yield. We look at the some of the options that advisers might be invited to consider.

Getting the balance right between additional non-negative income yield and additional downside risk will be key for investors and their advisers when preparing for and reacting to a NIRP environment.

Such a nice and interesting post.

I would definitely recommend this to others.

This is a really wonderful post. I would definitely recommend it to others.

Thank you for sharing this valuable information. I would definitely recommend it to others.

Thank you so much for sharing this valuable information with us.

Thank you so much for sharing this valuable information with us. 18/10/2022 15:16:11

This is an Excellent & great post. I LOVE this article! It’s such a beneficial for all visitors. Contact us on WHATSAPP for quick response. You can also start a LIVE CHAT session to place an order without any hassle. We recommend you to contact us even after placing the order using our forms. 31/10/2022 16:31:20

This is an Excellent & great post. I LOVE this article! It’s such a beneficial for all visitors. Contact us on WHATSAPP for quick response. You can also start a LIVE CHAT session to place an order without any hassle. We recommend you to contact us even after placing the order using our forms. 15/11/2022 14:14:38

This is an Excellent & great post. I LOVE this article! It’s such a beneficial for all visitors. Contact us on WHATSAPP for quick response. You can also start a LIVE CHAT session to place an order without any hassle. We recommend you to contact us even after placing the order using our forms. What is the purpose of a NIRP (Negative Interest Rate Policy) and how does it impact the interaction between the Central Bank and the wholesale banking system? How does a NIRP affect the rates between banks and interest rates on large cash deposits? Does a NIRP necessarily lead to negative retail lending rates? Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed