|

[5 min read, open as pdf]

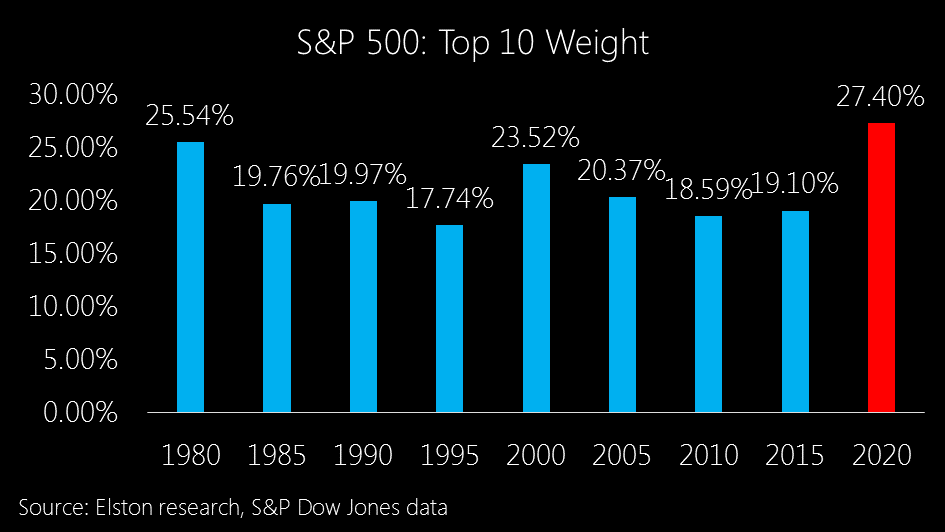

Tech performance is skewing cap-weighted indices The run up in technology stocks and the inclusion of Tesla into the S&P500 has increased both sector concentration and security concentration. The Top 10 has typically represented approximately 20% of the index, it now represents 27.4%. The chart below shows the Top 10 holdings weight over time. Rather than looking just at Risk vs Return, we also look at Beta vs Correlation to see to what extent each strategy has 1) not only reduced Beta relative to the market, but also 2) reduced Correlation (an indication of true diversification). Strategies with lower Correlation have greater diversification effect from a portfolio construction perspective. Ironically, the last time the index was anything close to being this concentrated was back in 1980 when IBM, AT&T and the big oil majors ruled the roost. From a sector perspective, as at end December 2020, Information Technology now makes up 27.6% of the index. Increased concentration reduces diversification This level of concentration is indeed skewing indices that rely on a traditional market capitalisation-weighted (cap-weighted) methodology, and does therefore reduce diversification. But the issue of the best performing stocks getting a larger weighting in the index, is not an accident of traditional index design. It’s its very core. Cap-weighted indices reflect the value placed on securities by investors, not the other way round. We should not therefore conflate the debate around “active vs passive” investment approaches, with the debate around index methodology. If portfolio managers are concerned about over-exposure to particular company or sector within a cap-weighted index, they can either chose an active, non-index fund, that is not a closet-tracker. Or they can access the target asset class through an alternatively weighted index, which uses a security weighting scheme other than market capitalisation. Using cap-weighted indices is an active choice The decision to use a fund that tracks an cap-weighted index is an active choice. And for those seeking differentiated exposure, there is a vast range of options available. We categorise these into 3 sub-groups: Style, Factor-based and Risk-based.

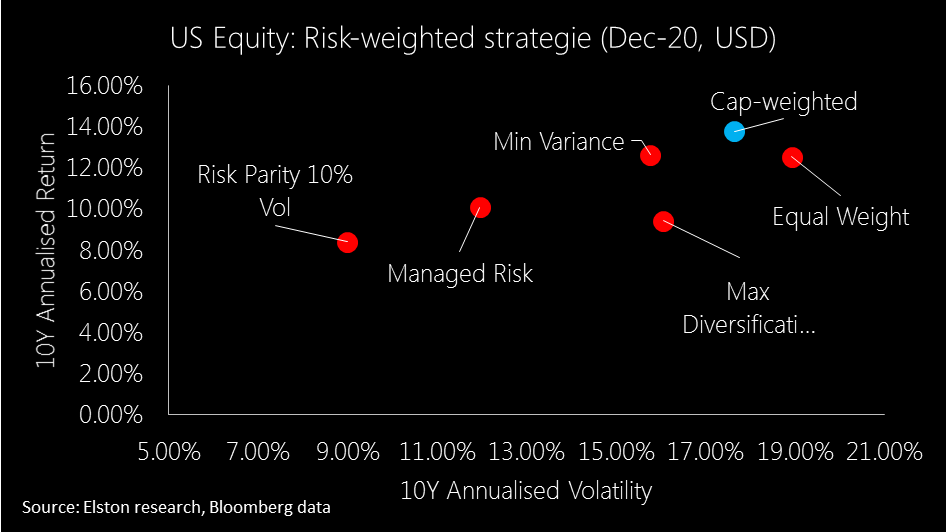

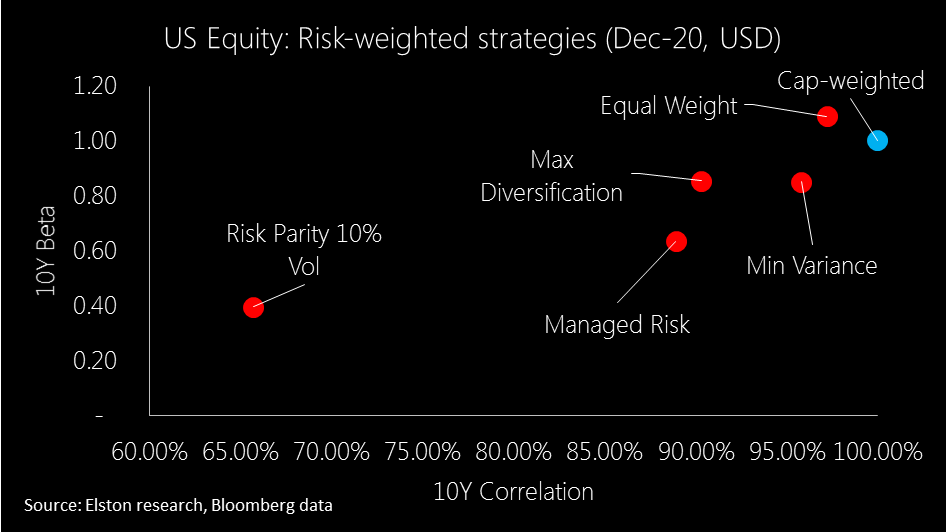

How have US equity risk-based strategies fared? Risk-based strategies have been in existence for some time, so we are able now to consider 10 year data (to December 2020, in USD terms). In terms of risk-adjusted performance, Managed Risk index strategies have fared best, whilst Min Variance has delivered higher returns for similar levels of risk of a Max Diversification strategy. Meanwhile Equal Weight has actually exhibited greater risk than traditional cap-weighted approach. In this respect, Equal Weight (Max Deconcentration), also disappoints delivering higher beta and >95% correlation. Likewise Min Variance, whilst delivering on Beta reduction, does not deliver on decorrelation. Max Diversification delivers somewhat on decorrelating the strategy from the S&P500, but only modestly, whilst Managed Risk achieves similar decorrelation, reduced beta and better returns. Finally Risk Parity 10% Volatility cap has delivered most decorrelation as well as beta reduction.

For more information about the indices and funds used to represent these different strategies, please contact us. Summary There are a broad range of alternatives to cap-weighted index exposures. But consideration of style-, factor- or risk-based objectives will necessarily inform portfolio construction.

Find out more For more insights and information on research, portfolios and indices, visit: www.elstonsolutions.co.uk or NH ETF<Go> Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed