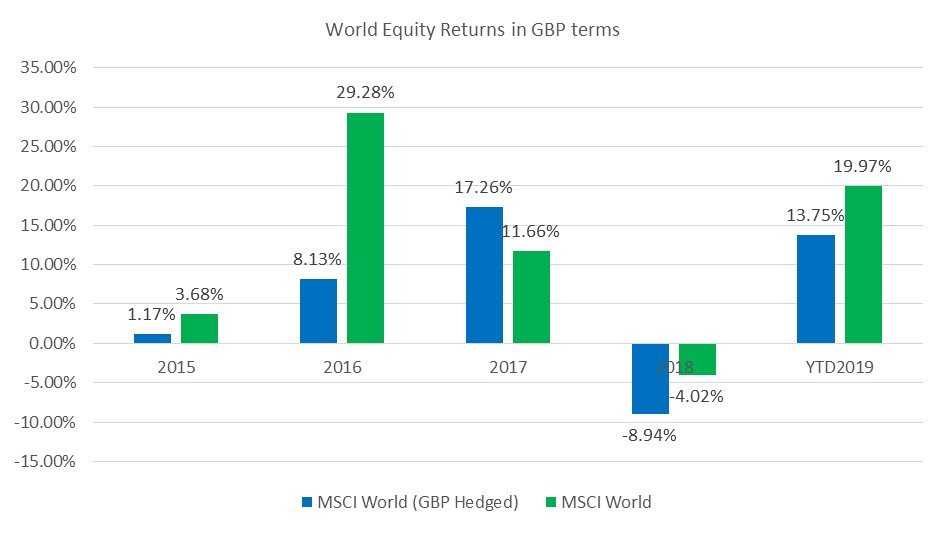

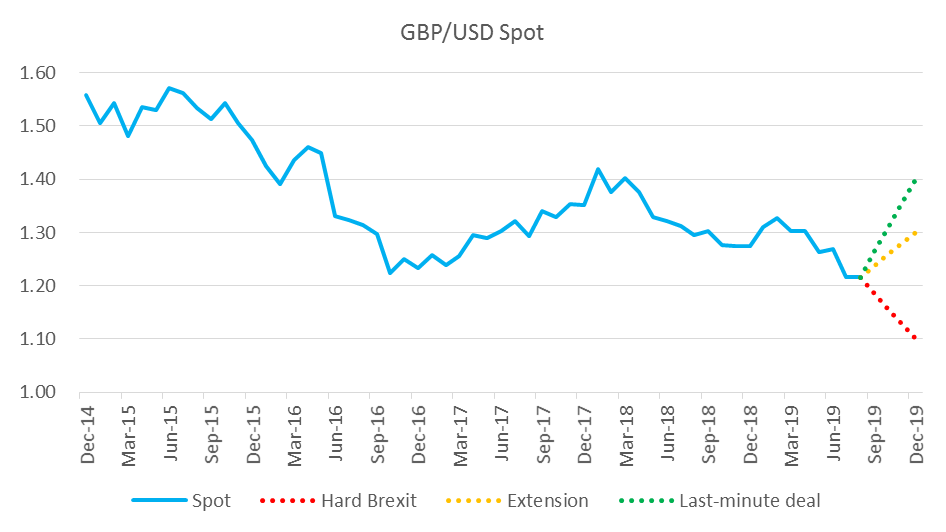

Political context There is certainly going to be continued uncertainty in the run up to the Brexit Hallowe’en. We outline three political scenarios. Hard Brexit: whilst Parliament has successfully passed a law to ensure the Government must apply for an extension if they cannot reach a deal by 31st October, there is still a risk of a Hard Brexit as there is an outside chance that the EU would not win unanimity from the EU27 to agree to grant an extension. 31st October 2019 exit from the EU therefore remains the legal default. Extension: if there is no deal by 31st October, and the UK Government seeks an extension from the EU and it is granted (for example 31st March 2020), then the can has been kicked down the road further, and there will likely be a General Election that will serve as a bitter and contested rerun of the Referendum campaign. That General Election will either result in one of 1) a “Leave” mandate led by a fractured Conservative/Brexit Party, or 2) a “Remain” mandate from a Remain Alliance led by Lib Dems, or 3) a Labour government and second referendum. Last-minute deal: there is an outside chance that the Prime Minister secures a Last-minute deal, that would be largely based on the existing Withdrawal Agreement, but with a Northern-Ireland only backstop. Whilst this would be the ultimate in “government by essay crisis”, it would at least provide resolution to this 3½ year saga, tragedy, comedy or farce (depending on theatrical preference). What about the economy? To gauge the UK economic outlook, we look at three key indicators: Growth, Inflation and Interest Rates. Growth: Despite low levels of unemployment, Brexit uncertainty is weighing on the UK economy with GDP contracting -0.2% in the second quarter. Both manufacturing and service sectors have already shown signs of entering a downturn. The uncertainty around Brexit could slow the growth down even more. The GDP growth for 2019 is still projected at 1.2% by the Bank of England. Inflation: Inflation is close to the Bank of England’s 2% target rate. Although the UK inflation is currently subdued, the expected rate of inflation remained at 3.2% . We estimate expected inflation using the 5 year breakeven rate, the difference between nominal and inflation-linked gilts yields. Put simply, this means that the market is expecting a higher level of inflation over the next five years than at present. Interest Rates: The UK yield curve continued to be flat at the end of 2q19. The spread between 2Y and 10Y bonds decreased further from 27bps to 21bps when compared with last quarter, the smallest gap since 2008. BoE’s chief Mark Carney’s recent speech warning an intensifying global risks added more concerns of a near-term recession. In our view, there is no change to the “lower for longer” outlook for UK interest rates. Asset class positioning In the context of political and economic outlook, what are our views on asset classes? Equities: Within an equity context, our portfolios do not have a domestic bias and are globally diversified, meaning that Brexit has limited impact on global equity risk compared to the bigger issues of the day, namely US-China trade disputes and US interest rate path. For reference, the UK is only about 6% of global equities (when counting both developed and emerging markets). So for globally diversified equity portfolios, Brexit has limited direct impact. Equities are long run return drivers and are exposed to a broad range of currencies in terms of the revenues of the global companies that make up each market. We do not believe that attempting to time the market for short run currency fluctuations, with regards to equity exposure, is worthwhile, and creates additional cost drag. Key question: to hedge or not to hedge However, for UK investors, currency positioning is key. In 2016, advisers that allocated to unhedged global equity exposure, and/or focused on large cap UK equities (e.g. the FTSE100) which have a high proportion of dollar revenues protected their clients from sterling devaluation. Fig.1. World Equity Returns in GBP terms: unhedged vs hedged Source: Elston research, Bloomberg data, total returns for respective ETFs. YTD 2019 is to 31-Aug-2019. iShares MSCI World (IWRD) and iShares MSCI World GBP Hedged (IGWD). All performance data in GBP terms. In the event of a no-deal Brexit (legal default), we expect further GBP weakness in which case an unhedged approach continues to make sense. In the event of an extension or a last-minute agreement, we expect GBP to recover towards 1.30 to 1.40 level respectively, in which case a tactical allocation to GBP-hedged global equity exposures would ensure global equity returns are delivered in sterling terms. Fig.2. GBP/USD Spot and potential levels under different scenarios Source: Elston research, Bloomberg data

Bonds: For bonds, most advisers rightly have a bias to domestic bonds for their clients to ensure alignment of client’s income and spending needs, as well as for protection in economic downturns (put simply: typically bond values are higher, when growth and interest rates are lower). We expect UK interest rates to remain lower for longer under all 3 scenarios, whilst inflation remains contained. If we saw risk of higher UK interest rates, we would look at allocating client assets to shorter duration (e.g. <5 year) UK bonds that are less sensitive to changes in interest rates. Alternatives: Property: We like property as a real asset that offers inflation protection. However, we see property as a potentially exposed asset class in the event of a no-deal Brexit. We would be concerned by the risk of reduced economic activity, business relocations and higher vacancies. For this reason our preference is for globally diversified funds that invest in shares of property companies, rather than for UK focused funds that invest in direct assets. Alternatives: Commodities: We like commodities as a diversifier owing to their less correlated relationship with equities and bonds. However as we are late in the cycle, we are cautious commodities. However we see Gold as a traditional defensive asset in uncertain times, and note the risk of sustained upward pressure on oil prices amidst geopolitical tensions in the Middle East. Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed