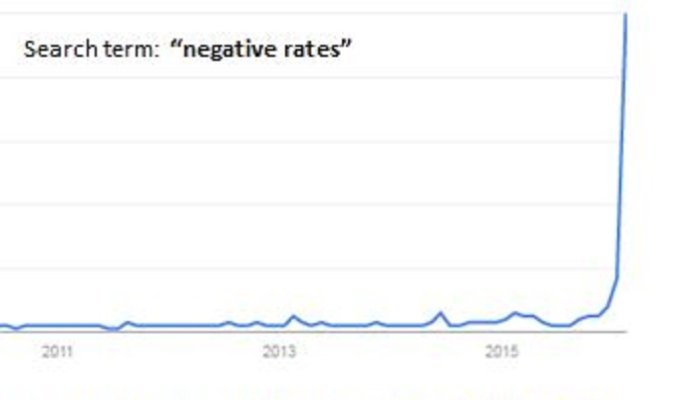

The Japanese did it. The Europeans did it. Even the educated Swedes did it. So will the Fed ever lower interest rates below zero? Markets fell out of bed last week on fears the Fed might shift from a Zero-Interest Rate Policy ("ZIRP") that alleviated the pain of the financial crisis to a Negative Interest Rate Policy ("NIRP") to keep the monetary stimulus to the economy alive. Why does it matter The "feasibility study" being undertaken at this stage is a long way from a policy announcement, but would indicate a very different interest rate path to December's announcement. This volte face alone would query the Fed's credibility. Add to that the known unknown of how markets might operate in this Through the Looking Glass world where you pay to lend money to the lender of last resort, and some basic assumptions around the supply of, and return on, capital have to be adapted. How does it "work"? The short answer is: we'll see. In theory, by charging financial institutions to sit on surplus cash, they are forced to put that cash to work, for example lending to corporates to keep their wheels turning. In this way, negative rates act as a stimulus to the velocity of money, rather than the quantum of money supply. What are the issues? Issue number one is that it turns the fundamental relationship between providers and users of capital on its head. Aside from that are the legal and technical issues around how NIRP can be implemented in any jurisdiction. But, as we have seen so far - where there's a will there's a way. The sector most vulnerable is the banking sector as negative interest rates wreak havoc on Net Interest Margins - the spread between banks' borrowing and lending rates that is the cornerstone of their profitability. Hence the rather brutal round of price discovery that took place in the banking sector as a response to this new known unknown. From negative yields to negative rates Short-term real yields on government debt (i.e. nominal yields, adjusted for inflation) went negative in 2008 during the financial crisis. Short-term nominal yields on government bonds, issued by, for example, the US and Germany, have dipped in and out of negative territory thereafter, as a safety/fear trade signaling that those investors would rather pay governments to guarantee a return OF their capital, than demand corporates to promise a return ON their capital. So economically speaking, negative yields are not new. But what is new is that negative interest rates are being adopted as a central bank policy. How have markets reacted? Markets hates grappling with new concepts where there is no empirical data from the past on which to make hypotheses. Hence the "shock" increase in risk premia despite the ostensible further lowering of the cost of capital. Renewed interest in gold is the natural reflex for those scratching their head as monetary policy grows "curiouser and curiouser". What next? Central banks are adding NIRP to the armory of "unorthodox" levers at theirdisposal to achieve orthodox aims. To what extent this new weapon is deployed will depend on the underlying development in fundamentals around growth, jobless rates and inflation targeting. Those targets set the course to which monetary policy will steer. Whether the new policy levers have more efficacy than the old remains to be seen. Baked beans, anyone? The UK's baked bean price war of the mid 1990s, provides a parallel to the topsy turvey economics of negative pricing. To gain and retain customer market share, the big three British supermarkets slashed baked bean prices to around 10p a tin. Tesco's then broke ranks and slashed prices further to 3p a tin (subject to max 4 cans per customer per day). Not to be outdone by its bigger rivals, Chris Sanders of Sanders supermarket in Lympsham, Weston Super Mare made history by selling baked beans for MINUS Two Pence (subject to max 1 can per customer per day). Janet Yellen - you now know whom to call. While it didn't alter the fundamentals of the retail sector, it did mark the end of an irrational era of skewed economics. For the optimists out there, perhaps NIRP heralds the same? Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed