Targeted Absolute Return (TAR) funds were meant to be “all-weather” funds that could deliver returns in up markets, whilst protecting capital in down markets. If that sounds like a “goldilocks” strategy, it’s because it is. However, the way these funds-of-strategies are managed can be complex and/or opaque, and the performance has been inefficient. They are not delivering. Given there’s been a lot of bad weather globally in the first half of this year, we look at how four leading (by AUM) TAR funds have fared against our Elston Dynamic Risk Parity Index. Absolute Return funds Targeted Absolute Return funds are designed to fulfil a diversification function within a portfolio. This means performing in a way that is less or not correlated with equity markets, whilst offering greater return than cash or bonds. The portfolio construction approach to TAR funds differs from manager to manager. But the guiding principle is to achieve diversification by “spreading risk” across multiple, uncorrelated strategies, and “having the potential to make money in falling markets”. Risk-based strategies as an alternative Our view is that if the objective is diversification, a risk-based approach to portfolio construction makes sense, using strategies such as Risk Parity for diversification purposes. Risk Parity ensures “true diversification” by allowing the ever-changing risk characteristics of each asset class to determine portfolio weights, such that each asset class contributes equally to overall portfolio risk. Furthermore, by constructing the strategy as a straightforward “long-only” approach that does not use leverage, the holdings within the strategy are liquid, transparent and low-cost ETFs, whilst the dynamic weighting scheme is the tool for ensuring equal risk contribution and volatility constraint.

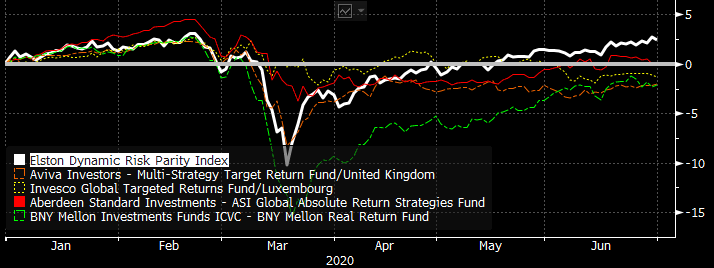

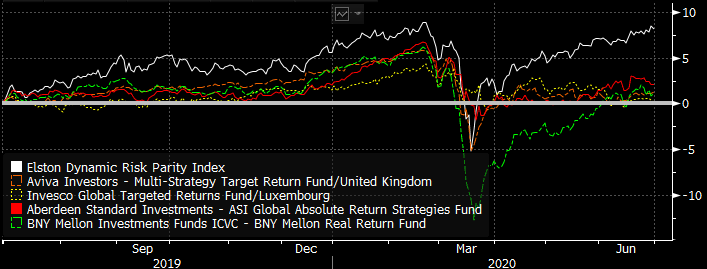

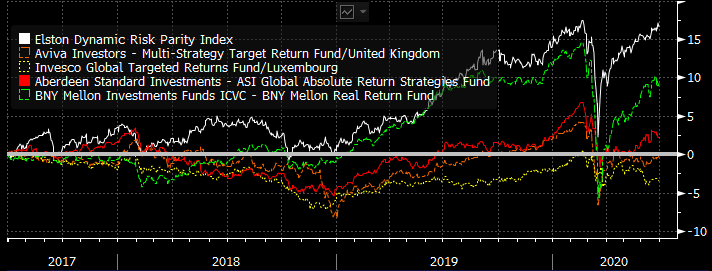

So how have the strategies fared? Relative Performance Year to date, through an extreme stress-test, absolute return strategies have underperformed a Risk Parity approach by 2-4.5%. Fig.1. YTD performance Source: Elston research, Bloomberg data. Total returns, GBP terms, as at end June 2020 On a 1 year view, these absolute return strategies have underperformed a Risk Parity approach by 6-8%. Fig.2. 1 year cumulative performance Source: Elston research, Bloomberg data. Total returns, GBP terms, as at end June 2020 On a 3 year view, these absolute return strategies have underperformed a Risk Parity approach by 7-20%. Fig.3. 3 year cumulative performance Source: Elston research, Bloomberg data. Total returns, GBP terms, as at end June 2020 Mixing metaphors: a goldilocks approach to an all-weather portfolio To achieve all-weather diversifier status is a tall order for any investment strategy. It requires a “goldilocks” portfolio that:

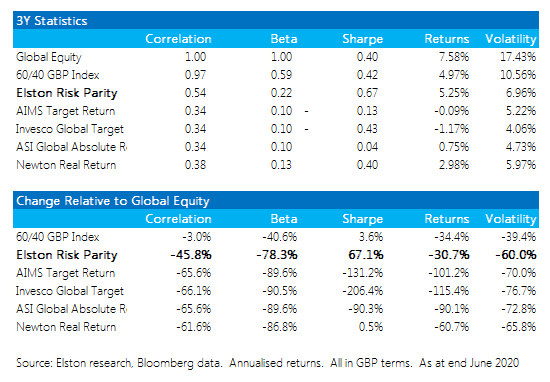

On this basis, our Risk Parity strategy fares well as a decorrelated “diversifier”, without foregoing returns, for a similar level of risk to TAR funds. What’s wrong with TAR funds? We can’t analyse the individual strategies within the funds, but in aggregate, the statistics below suggest that as a result of their complexity, TAR funds have potentially “over de-correlated”, with insufficient beta to capture the returns available for the risk (volatility) being taken. Findings are summarised in the table below. Fig.4. 3Y Performance Statistics Risk-based strategies: an alternative to absolute return funds?

Targeted Absolute Return funds are opaque, complex and inefficient. Creating a true diversification strategy is challenging but achievable. A systematic risk-based approach that adapts to changing relationships between each asset classes is an alternative. By ensuring that each asset class contributes equally to the risk of the overall portfolio, without resorting to leverage, could provide a more dependable approach to incorporating a “true diversifier” into a portfolio, without necessarily compromising returns. NOTICES Commercial Interest: Elston Consulting Limited creates research portfolios and administers indices that may or may not be referenced in this article. If referenced, this is clearly designated and is to raise awareness and provide purely factual information as regards these portfolios and/or indices. Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed