Introducing Elston All-Weather Portfolio UK

About this strategy

Why this strategy

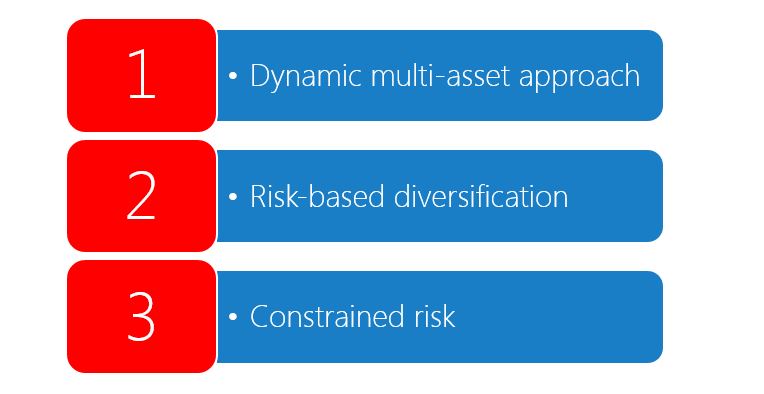

The concept of the all-weather portfolio is to deliver steady returns in all different types of market regime, whilst constraining risk.

Our all weather portfolio strategy aims to:

1. Deliver a steady return premium

What: The strategy aims to deliver a positive return premium to bonds in all market conditions.

How: The strategy dynamically allocates across asset classes, depending on changing risk, return and correlation characteristics.

2. Preserve capital in all conditions

What: The strategy aims (but cannot guarantee) not to lose capital value in any 12 month rolling period and avoid large losses.

How: The strategy has a risk level similar to bonds, and constrains risk to minimise drawdowns for downside cushioning.

3. Provide true "risk-based" diversification:

What: The strategy acts as a risk-based diversifier by providing reduced correlation to an equity/bond portfolios.

How: Changing risk characteristics determine asset-weights, rather than vice versa. This gives more effective diversification that is risk-based, not asset-based.

What's the science behind this strategy?

The design principle behind this strategy is called "Equal Risk Contribution", also known as "Risk Parity". It optimises the weight of each asset class, so that each asset class contributes an equal amount of risk to the overall strategy. This means that instead of asset weights determining portfolio risk contributions, portfolio risk contributions determine asset weights.

What's under the bonnet?

The strategy is constructed six liquid low-cost physical ETFs representing major asset classes: UK equities, global equities, UK bonds, UK property, gold and ultrashort bonds (cash equivalents).

Is that all?

Yes. That's all. No leverage, no shorting, no hedging, no pair trades. The elegance of this approach is to use a dynamically changing weighting scheme (the weights changes each month) to derive the return premium.

Is there a history?

You can view the history of this strategy's benchmark which uses a systematic rules-based approach to Risk Parity for GBP investors.

Benchmark: Elston Dynamic Risk Parity Index launch date 2018, start date: 2011, strategy simulation start date 1997.

Benchmarking this strategy

We use a "Risk Parity" approach (also known as Equal Risk Contribution) to benchmark our All Weather Portfolio strategy. Our benchmark is codified and published as the Elston Dynamic Risk Parity Index.

How does the portfolio strategy differ from the index

For the index, we use regional equities as it enables greater diversification and differentiation.

Find out more about the benchmark

You can find out more about the benchmark index for this strategy below.

Index Objectives

The Elston Dynamic Risk Parity Index strategy is a multi-asset risk-based strategy. The index strategy is designed to allocate dynamically to a diverse range of asset classes such that each asset class exposure contributes equal risk to the overall strategy. The strategy also limits the overall level of volatility.

The index provides a systematic rules-based approach for providing risk-based diversification with differentiated returns and constrained risk.

The concept of the all-weather portfolio is to deliver steady returns in all different types of market regime, whilst constraining risk.

Our all weather portfolio strategy aims to:

1. Deliver a steady return premium

What: The strategy aims to deliver a positive return premium to bonds in all market conditions.

How: The strategy dynamically allocates across asset classes, depending on changing risk, return and correlation characteristics.

2. Preserve capital in all conditions

What: The strategy aims (but cannot guarantee) not to lose capital value in any 12 month rolling period and avoid large losses.

How: The strategy has a risk level similar to bonds, and constrains risk to minimise drawdowns for downside cushioning.

3. Provide true "risk-based" diversification:

What: The strategy acts as a risk-based diversifier by providing reduced correlation to an equity/bond portfolios.

How: Changing risk characteristics determine asset-weights, rather than vice versa. This gives more effective diversification that is risk-based, not asset-based.

What's the science behind this strategy?

The design principle behind this strategy is called "Equal Risk Contribution", also known as "Risk Parity". It optimises the weight of each asset class, so that each asset class contributes an equal amount of risk to the overall strategy. This means that instead of asset weights determining portfolio risk contributions, portfolio risk contributions determine asset weights.

What's under the bonnet?

The strategy is constructed six liquid low-cost physical ETFs representing major asset classes: UK equities, global equities, UK bonds, UK property, gold and ultrashort bonds (cash equivalents).

Is that all?

Yes. That's all. No leverage, no shorting, no hedging, no pair trades. The elegance of this approach is to use a dynamically changing weighting scheme (the weights changes each month) to derive the return premium.

Is there a history?

You can view the history of this strategy's benchmark which uses a systematic rules-based approach to Risk Parity for GBP investors.

Benchmark: Elston Dynamic Risk Parity Index launch date 2018, start date: 2011, strategy simulation start date 1997.

Benchmarking this strategy

We use a "Risk Parity" approach (also known as Equal Risk Contribution) to benchmark our All Weather Portfolio strategy. Our benchmark is codified and published as the Elston Dynamic Risk Parity Index.

How does the portfolio strategy differ from the index

For the index, we use regional equities as it enables greater diversification and differentiation.

Find out more about the benchmark

You can find out more about the benchmark index for this strategy below.

Index Objectives

The Elston Dynamic Risk Parity Index strategy is a multi-asset risk-based strategy. The index strategy is designed to allocate dynamically to a diverse range of asset classes such that each asset class exposure contributes equal risk to the overall strategy. The strategy also limits the overall level of volatility.

The index provides a systematic rules-based approach for providing risk-based diversification with differentiated returns and constrained risk.

Strategy Information

|

Elston Dynamic Risk Parity Index [ESBDRP Index]

Index Objectives: We launched and manage the Elston Dynamic Risk Parity Index a risk-weighted multi-asset index whose asset allocation varies such that each asset class exposure contributes equal risk to the overall strategy. The strategy also limits the overall level of volatility, by deallocating to ultra-short duration bonds if markets are too volatile. Format: Non-significant Benchmark Index Data Contributors: Elston, Milliman Methodology Owner: Elston Benchmark Index Administrator: Elston Fund InformationVT Elston Dynamic RIsk Parity Fund

[Information to follow] |

|